Bayview Eden Hotel Melbourne sold for major residential redevelopment - JLL

Contact

Bayview Eden Hotel Melbourne sold for major residential redevelopment - JLL

Bayview Eden Hotel at 6-9 Queens Road Melbourne sold to Prominent developer Home, backed by Singaporean investor GIC, by JLL’s Josh Rutman, Peter Harper, Nick MacFie and MingXuan Li.

Prominent developer Home, backed by Singaporean investor GIC, has purchased the Bayview Eden Hotel at 6-9 Queens Road to develop one of Australia’s largest Build to Rent (BTR) projects, and build upon its enviable pipeline of new purpose-built facilities.

Home Albert Park will deliver 560 apartments designed for the Melbourne rental market to help ease Melbourne’s chronic housing supply shortage.

The building will offer a mix of studio 1, 2 and 3 bedroom apartments to provide a range of living options and price points and a ground floor café in the adjoining 19th century mansion, Netherby.

The marketing campaign and deal were exclusively handled by JLL’s Josh Rutman, Peter Harper, Nick MacFie and MingXuan Li.

JLL Victoria Capital Markets Executive Director Josh Rutman said the large landholding attracted interest from hotel investors, land bank investors and more traditional developers.

“We have been fortunate to handle some prominent sales in recent years along St Kilda Road and Queens Road, but this is the second largest wholly owned landholding in the entire precinct, and we weren’t surprised to see the gravitational pull that it had on interest from some of the industry’s major players who understand the rarity of such an opportunity,” said Mr Rutman.

The 4-star Bayview Eden occupies a significant 6,974 sqm site and currently comprises 192 rooms, a restaurant & bar, extensive conferencing & event facilities, swimming pool and large basement carpark together with a period mansion known as Netherby House.

JLL Hotels & Hospitality’s Managing Director and Head of Investment Sales Australasia, Peter Harper said, “With the volume of new supply entering the Melbourne hotel market over the past couple of years and the consequential structural change in trading conditions, we are increasingly seeing the perceived highest and best use of existing assets favour adaptive re-use or complete redevelopment. This is JLL’s third Melbourne hotel sale in around 12 months in which developers have outbid hotel investors.”

He added, “In an environment where capital values are being questioned in many cases, owners of older hotel assets with strong underlying real estate fundamentals should take great comfort in how pricing is holding up given the multitude of future opportunities these properties offer. We’re currently in the process of transacting two other Melbourne assets on a similar basis and expect other sales of this nature over the balance of the year. This isn’t a localised theme either with similar deals occurring nationally, headlined by the sale of the Sir Stamford Circular Quay in Sydney earlier this year for $210.5 million.”

The sale is also the latest example of larger holdings in the St Kilda Road precinct changing hands with developers looking to deliver new residential product and capitalising on the demand drivers in the area for both purchasers and renters. Prior to this deal, Mirvac was the most recent entrant to acquire a landholding on Queens Road for residential redevelopment.

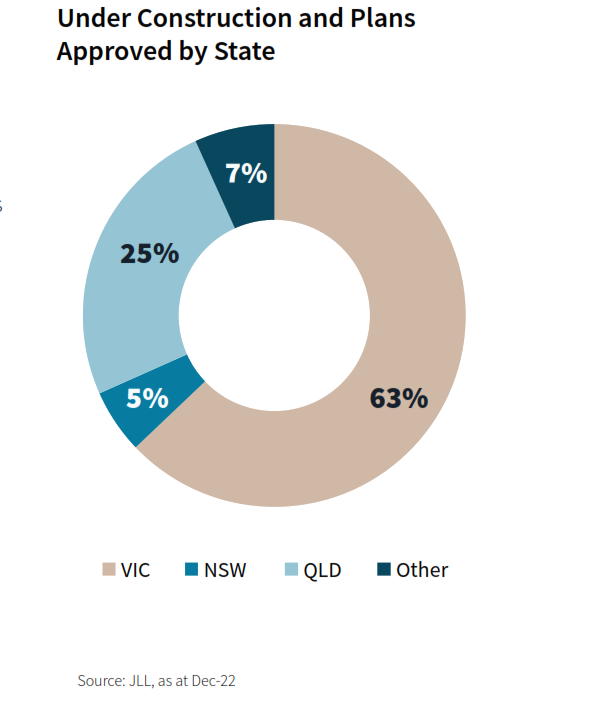

“With the current challenges for traditional local developers being well publicised, the timing for institutionally-backed groups to pursue inner-city landholdings has never been more opportune. We expect that this trend will continue for larger scale sites whilst the volatility continues for debt and construction costs.”, Mr Rutman said.

He added, “We are in the midst of a well-documented housing shortage, and despite the call for more construction, there has been no shortage of hurdles for developers and their financiers to jump over. Whilst it’s not a silver bullet, Build to Rent developers are a cohort that is capable of commencing construction sooner and the calls for smoother approval processes and more conducive tax treatment seem to be well founded.”

In another recent BTR deal along Queens Road, JLL recently transacted Bayview on the Park hotel at 50-52 Queens Road which was sold to Altis Property Partners and Aware Super who will be undertaking another Build-To-Rent development with plans for 300 apartments on the site. At $72.7 million, this was one of the largest inner-city land deals in Melbourne, now being surpassed by the Bayview Eden transaction. Other recent BTR site sales include 155 Johnston Street, Fitzroy to Greystar for around $30 million and 36-58 Macaulay Road, North Melbourne which sold to Hines for $29 million.