Pace to divest major North Melbourne site ‘The Village’ for sale

Contact

Pace to divest major North Melbourne site ‘The Village’ for sale

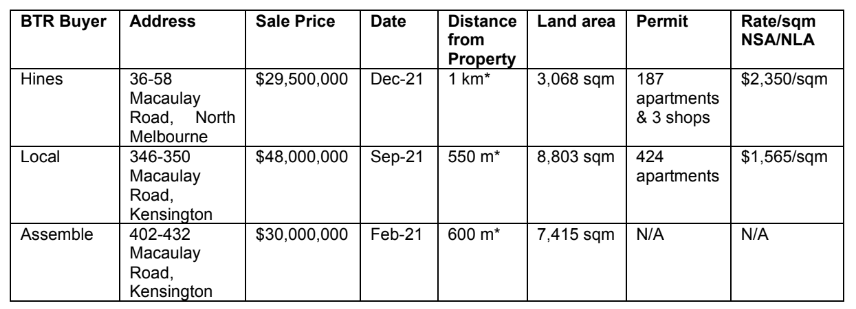

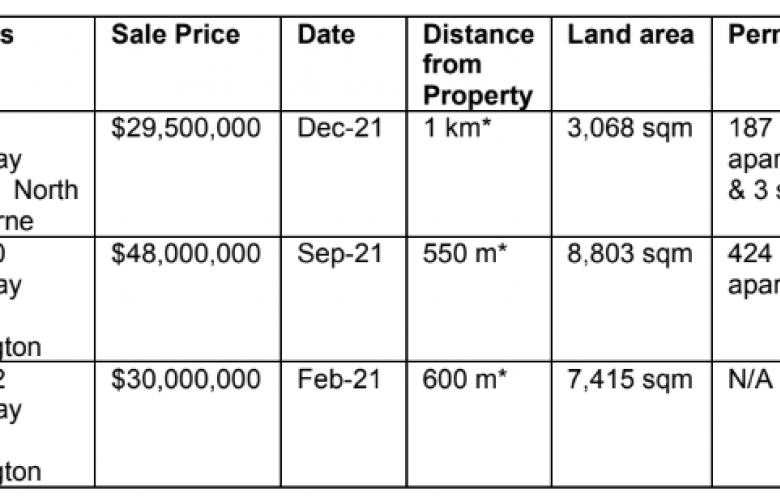

Melbourne-based developer, Pace Development Group, is seeking to capitalise on the recent upsurge of nearby build-to-rent market activity through a divestment of their 1.32ha permit- approved North Melbourne supersite for sale by Stonebridge Property Group’s Julian White and Chao Zhang, and CBRE’s David Minty, Nathan Mufale and JJ Heng, acting under instructions from transaction manager, Advise Transact.

The property, with extensive frontages to both Alfred Street and Racecourse Road, has planning permission to deliver more than 54,000sqm of NSA/NLA over three stages, making it one of the largest publicly marketed and permit-approved sites for sale in Melbourne of late.

The Commercial 1 and Mixed-Use zoning provides flexibility for modified use outcomes, including a dedicated build-to-rent master planned village.

The property benefits from exceptional amenity, including proximity to Flemington Bridge Train Station and the number 57 tram, providing direct access to the Melbourne CBD and the highly regarded hospital and university precincts. In addition, the site is only 1 km* away from the future Arden Metro Tunnel station which will provide a direct link to Melbourne Airport via the Melbourne Airport Rail.

Chief Operating Officer of Pace Development Group, James Simpson, said “Pace has seven projects commencing construction in 2022. Given the scale of the site and momentum of build- to-rent activity in the precinct, timing is right to divest. A divestment will enable us to focus on the delivery of our existing build-to-sell and commercial projects, while bolstering investment in new development sites that provide a sustainable pipeline of future delivery.”

The International Expressions of Interest campaign will be handled by Stonebridge Property Group’s Julian White and Chao Zhang, and CBRE’s David Minty, Nathan Mufale and JJ Heng, acting under instructions from transaction manager, Advise Transact.

Mr White said “The scale of the site allows for a master planned village to be created, that will be precinct defining. There are also excellent market fundamentals to support a project of this scale, including an impending undersupply of residential accommodation in Melbourne and a compressed rental vacancy rate.”

David Minty of CBRE said “With nearby Kensington being the first mover and most active CBD fringe Build-To-Rent market, ‘The Village’ will offer buyers a de-risked gateway site closer to the CBD at a more attractive value proposition”

Luke Mackintosh, who leads the built-to-rent arm of the Real Estate Advisory team at Big 4 consultancy EY, said “We believe that Melbourne is facing a shortage of rental accommodation as we return back to normal, particularly in key inner- city locations such as North Melbourne, where the majority of the population are young renters who require to live and be in proximity to universities and places of work.”

“The current residential vacancy rates in North Melbourne have returned back to pre-Covid levels and we anticipate that Net Overseas Migration of students and skilled workers will return to the historical levels observed in Victoria. This will continue to create a scarcity in rental stock with the private residential development sector facing significant difficulties in delivering new housing due to a lack of FIRB Investors entering the market, difficulty in financing projects and rising construction costs.” concluded Mr Mackintosh.

These views are shared by many build-to-rent market participants, including as written in the Australian Financial Review dated 4 May 2022. Representatives from developers Mirvac and Local said at the Macquarie Australia Conference that inflation and supply issues make conditions for build-to-rent projects almost perfect, with Australia well behind the supply cycle of the US and UK.

Expressions of Interest are due Wednesday 29th June at 2pm, with market interest expected to be upwards of $45 million for the site.

To request a copy of the Information Memorandum please contact one of the marketing agents via the contact details below.