Developer incentives to drive new land market as sales fall

Contact

Developer incentives to drive new land market as sales fall

Savvy buyers should prepare to capitalise on a sluggish market with developers looking to complete deals on new land sales in Victoria in the lead up to Christmas, according to RPM National Managing Director Project Marketing Luke Kelly.

Savvy buyers should prepare to capitalise on a sluggish market with developers looking to complete deals on new land sales in Victoria in the lead up to Christmas, according to RPM National Managing Director Project Marketing Luke Kelly.

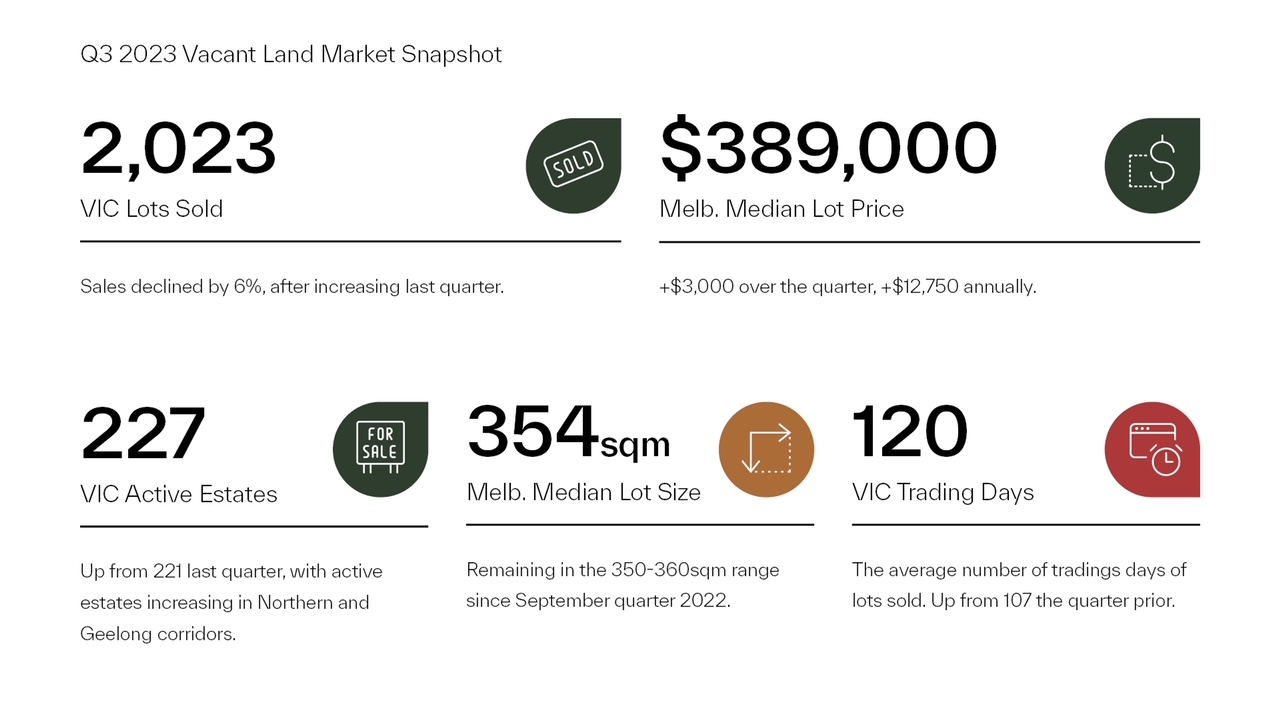

The latest Greenfield Market Report from RPM Research, Data & Insights shows lot sales across the Melbourne and Geelong growth areas fell 6 per cent to 2,023 lots in the September quarter with sales for the 12 months to September 2023 down by 58 per cent to 8,129 lots.

It comes after sales rose 13 per cent in the second quarter to 2,146 lots, fuelling hopes of the start of a recovery.

The median lot price rose by 1 per cent in Q3 to a new record of $389,000, although that figure does not include developer incentives being offered to buyers, which range from 5 to 10 per cent off the headline price.

Prospective buyers continue to face a multitude of hurdles from reduced borrowing capacity (down by 30 per cent from April 2022) through to stubborn inflation and cost of living pressures, which are likely to see sales numbers remain suppressed for the remainder of 2023 and well into 2024.

New supply fell to a new low of 1,538 lots – down 17 per cent from the previous quarter with the average time on market blowing out to five months.

Mr Kelly said quarter two’s gains had fluctuated due to a multitude of challenges facing buyers including affordability, a reduction in borrowing capacity, and the rising cost of living.

“It appears the June quarter may have been an aberration and not a sign of an upward trajectory, although in good news, while sales were down in Q3 compared to the previous quarter they remain above the first quarter of the year,” Mr Kelly said.

“Pressure on demand remains strong, however, due to persistent inflation and the latest increase to the cash rate this month, the market looks like it will remain subdued for some time.

“Additionally, there is substantial unsold developer stock on market, which continues to grow. This coupled with existing stock from previous buyers selling land they can no longer build on due to difficulties in obtaining finance for construction has kept lot prices in check.”

Mr Kelly said, in positive news for those in a position to buy, the sluggish quarter had spurred developers to complete deals to shift stock in the weeks leading up to Christmas.

“Developers have less than two months to shift the titled stock on their books which has led to a significant increase in incentives being offered to buy now, which are sitting in the range of 5 to 10 per cent off the headline price,” Mr Kelly said.

“It is not just the developers putting out these incentives – builders have joined the party as well, with the combination of developers and builders working in harmony to drive significant savings in the order of $50,000 or more for new purchasers.

“This means buyers in a financial position to purchase can capitalise on the incentives in the market. Some may not settle on their lot for 12 to 18 months when the cycle may have turned, meaning potential capital gains alongside a different interest rate environment.”

CORRIDOR MARKET ACTIVITY IN Q3 2023:

- Sales in the Western Growth Corridor fell by 6% to 765 lots in Q3, a 33% drop from the same quarter last year. The corridor’s total lot sales as a percentage of all growth corridors remained at a three year low of 38%. New supply dropped by 22% to 611 lots, which is the lowest figure since Q3 2013 and a result of developments focussing on absorbing current stock. The median lot price and median lot size shrank slightly over Q3 to $385,000 and 350sqm respectively. Owner occupiers made up 59% of purchasers in the Western corridor – the equal lowest of all four Melbourne areas – with first-home buyers making up 68% of that figure.

- The Northern Growth Corridor accounted for just 33% of gross lot sales across all corridors in Q3 down from 35% the previous quarter, which was a decade-long high. Sales fell by 11% over the three-month period to 664 lots while new supply was also down by 10% to 519 lots. The median lot price remained steady at $370,000 making the Northern Growth Corridor affordable relative to the Western and South Eastern Corridors. Owner occupiers made up 71% of purchasers, with slightly more than half being first-home buyers.

- The South East Corridor was the standout of the Melbourne growth corridors with sales increasing by 1% to 457 lots, largely centred in Casey. New lot supply grew by 18% while remaining low by historic averages. The median lot price, the most expensive of all the corridors, fell slightly by 1% to $435,000. Owner occupiers comprised 80% of all buyers with first-home buyers accounting for just over half despite the high price tag.

- Sales remained low in the Geelong Growth Corridor in Q3 after last quarter’s historic low. There were 137 sales for the quarter, which was a 1% increase, with the average time on market lifting to about five months. New supply fell sharply by 57% to 63 lots, marking a decade-long low. Affordability is a key concern with submarkets such as Armstrong Creek now more expensive than many Melbourne areas. Owner occupiers held a 59% share of buyers with Geelong taking the prize for the lowest proportion of first-home buyers at just 41%.

Click here to view and download the report.