Stonebridge Property Group releases mid-year update on The Victorian development site sector

Contact

Stonebridge Property Group releases mid-year update on The Victorian development site sector

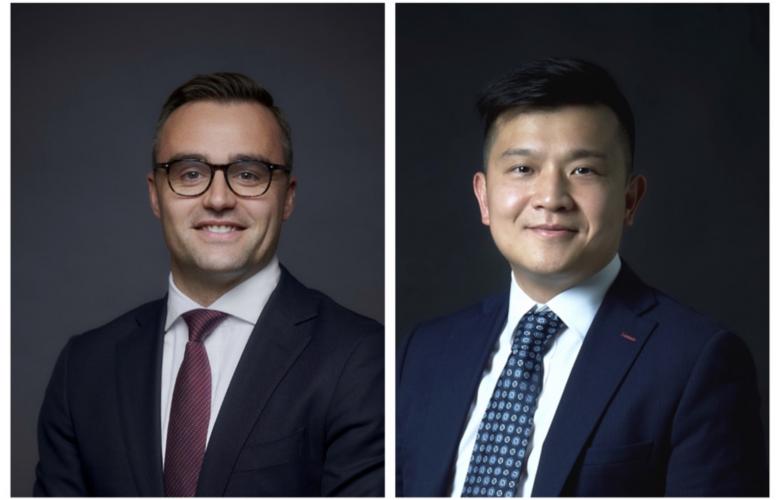

Mr Julian White commented on the Stonebridge Property Group mid-year report on the Victorian development site sector, whilst the headlines in the media have been mixed over the first half of the year, we are finding the market transactional, with developers regularly commenting on the fundamentals of residential undersupply, population growth, and strong job and wage data, as key drivers for their desire to acquire.

As highlighted within the Stonebridge Property Group mid-year report on the Victorian development site sector, Mr Julian White commented whilst the headlines in the media have been mixed over the first half of the year, we are finding the market transactional, with developers regularly commenting on the fundamentals of residential undersupply, population growth, and strong job and wage data, as key drivers for their desire to acquire.

Stonebridge Property Group’s key takeouts from the first half of 2023, include:

- An increasing in listing volumes, albeit with still a severe shortage of premium quality sites.

- No change in pricing of premium sites, but secondary sites have seen varying levels of adjustment to market factors.

- An underlying sense from the market that the next cycle of the residential market is imminent. Our enquiry numbers on campaigns have held, and bids have been received on all sites, highlighting this point.

- A continued increasing interest from Asian capital, particularly new Chinese capital, reviewing our stock. Higher portions of buyer activity have been in sub $10 million stock.

Stonebridge Property Group’s eight-agent strong specialised development site sales team is the largest in the Victorian market said Mr White. We have operators focused on sub sectors including the CBD and city fringe, suburban and greenfield markets, ensuring an in-depth knowledge and understanding can be applied on any development site offering.

Please click here to see attached Stonebridge Property Group’s mid-year update on the Victorian development site sector.

ASIAN CAPITAL IS FLOWING INTO COMMERCIAL REAL ESTATE

Chinese investment has continued pouring in for Australian real estate. The signs have been obvious for the residential sector with demand from foreign buyers overall having risen to a market share of 7.9% across the country. Incidentally, this foreign appetite for investment has also spilled over to commercial property says Chao Zhang.

For a detailed update on Asian capital, please click here to watch a video update from Chao Zhang.