Colliers - 2024 Australia’s BTR sector

Contact

Colliers - 2024 Australia’s BTR sector

Real estate allocations from sophisticated investors are being attracted to the residential thematic via an asset type that is only now becoming available in the Australian market” said, Robert Papaleo National Director, Capital Markets Residential, Australia.

Investment activity is forecast to increase steadily across the Asia Pacific region in 2024 , according to Colliers’ (NASDAQ and TSX: CIGI) 2024 Global Investor Outlook.

This year’s report points to steadily increasing activity in APAC markets throughout 2024 as certainty around the policy environment takes hold, gaps between buyers and sellers narrow and more investors move to deploy capital.

“2024 definitely looks more positive than 2023, with a lot of pent-up equity which is looking to find a home,” Chris Pilgrim, Colliers Managing Director of Global Capital Markets, Asia Pacific, said. “The depth of capital in most Asian markets has to diversify.

BTR Australia:

Given the dynamics of declining affordability, elevated population growth and new supply headwinds across Australia's major cities, interest in the emerging build-to-rent sector has increased from a range of capital sources. Several announced changes to federal and state tax settings are undoubtedly reinforcing the appeal of investment in Australia’s BTR sector.

Both incumbent and new entrant international capital partners, alongside increasing numbers of domestic institutions, are seeking exposure to the low-risk nature of Australia's residential real estate given its undeniable market fundamentals and policy imperatives. Real estate allocations from sophisticated investors are being attracted to the residential thematic via an asset type that is only now becoming available in the Australian market” said, Robert Papaleo National Director, Capital Markets Residential, Australia.

International Capital Asia Pacific:

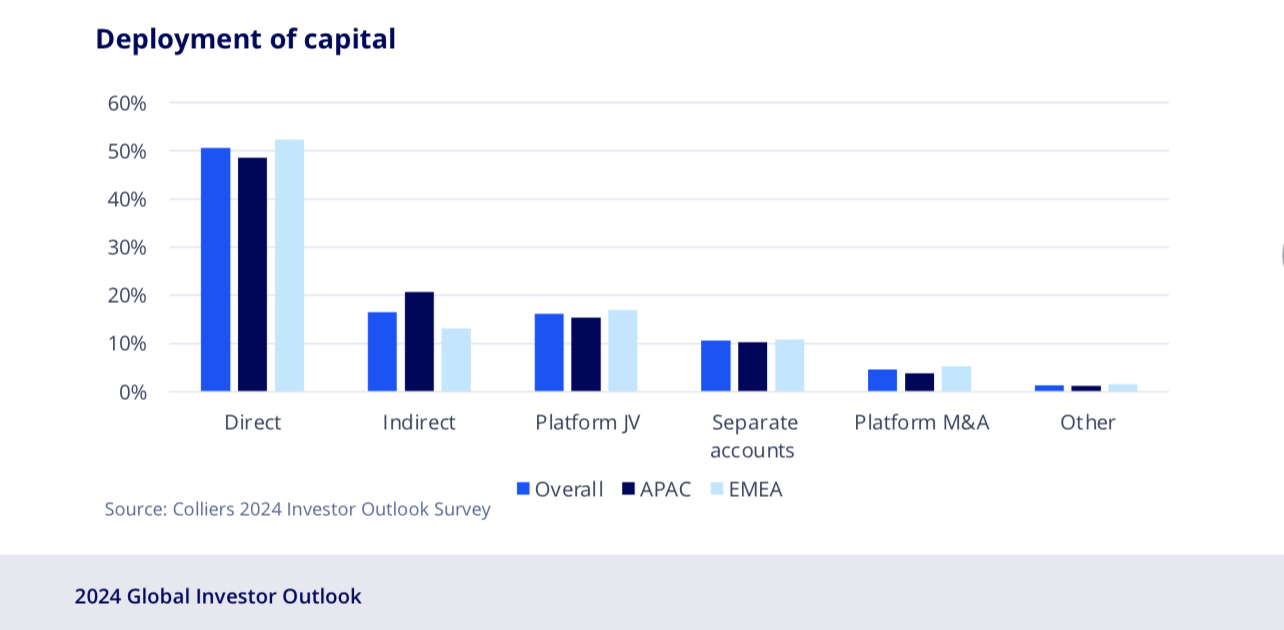

With most big institutions or funds in the region having increased allocations to real estate, just the sheer quantum of capital they have to deploy means we're likely to see more indirect strategies. In sectors like build-to-rent, the thematic of partnership with best-in-class developers and managers is very much in place. Certainly, a partnership can provide the ability to access a market or product without necessarily the full responsibility of the operational side of it as well.” Commented, John Howald Executive Director & Head of International Capital, Asia Pacific.

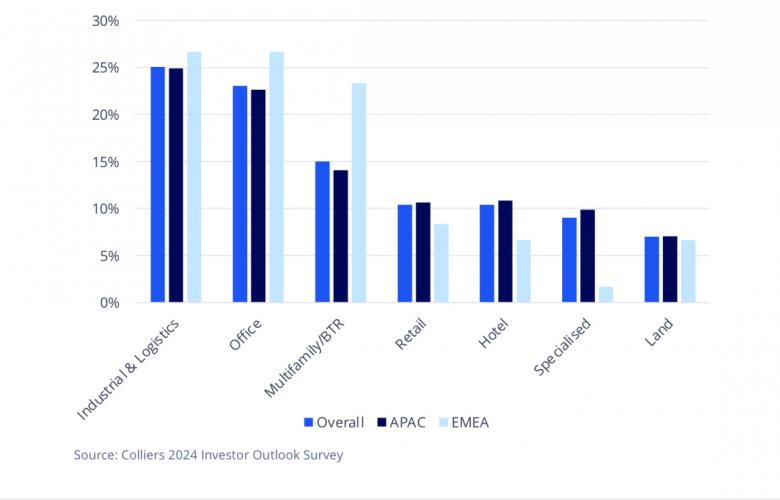

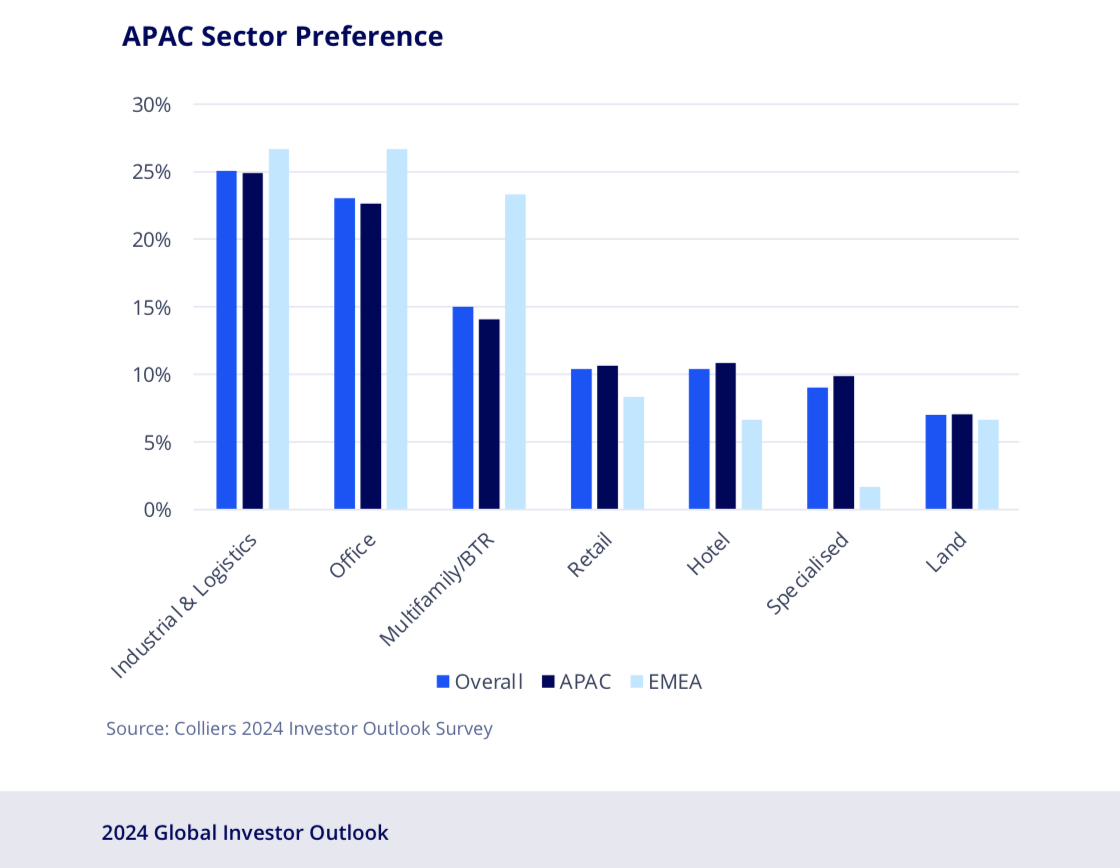

The APAC region:

The APAC region has shown resilience, despite a challenging global environment. This has translated into Investment activity across the region which has accounted for 23% of total global investment volumes YTD 2023, which is 5 percentage points higher than the long-term average of 18%. APAC sales volumes are only down by 30% compared to 2022 levels, whereas global investment activity is down by almost 50%8.

We expect APAC’s commercial property market will continue to uphold its strong position on the global stage over 2024 and contribute to a growing share of global investment activity". Said, Joanne Henderson National Director, Research, Australia

About the 2024 Global Investor Outlook

The fourth edition of our annual outlook for global property investors synthesizes the views of Colliers Capital Markets experts and the results of a survey of international investors. The findings and opinions featured in the report are shaped by their responses.

Related Reading:

Ahmed Fahour AO to join Gurner Group as CEO | The ASEAN Developer