Melbourne Land Prices Hold Firm In September - Oliver Hume

Contact

Melbourne Land Prices Hold Firm In September - Oliver Hume

Gross land prices across Melbourne edged slightly higher in the September quarter to reach a record high, according to new research from property services group Oliver Hume.

Gross land prices across Melbourne edged slightly higher in the September quarter to reach a record high, according to new research from property services group Oliver Hume.

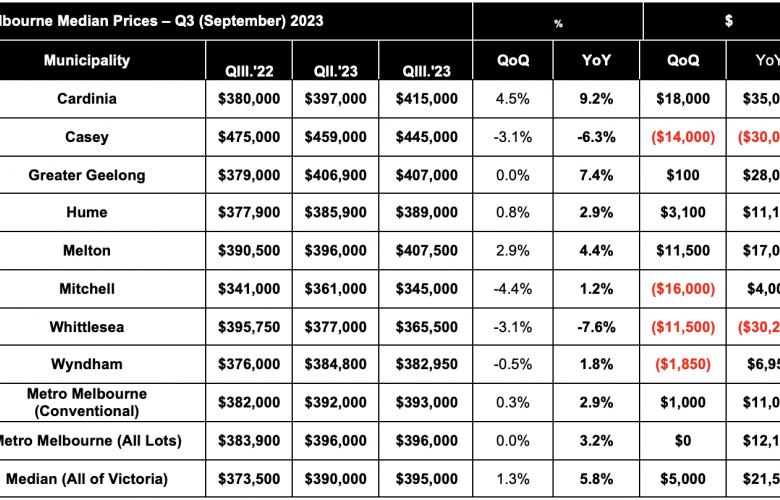

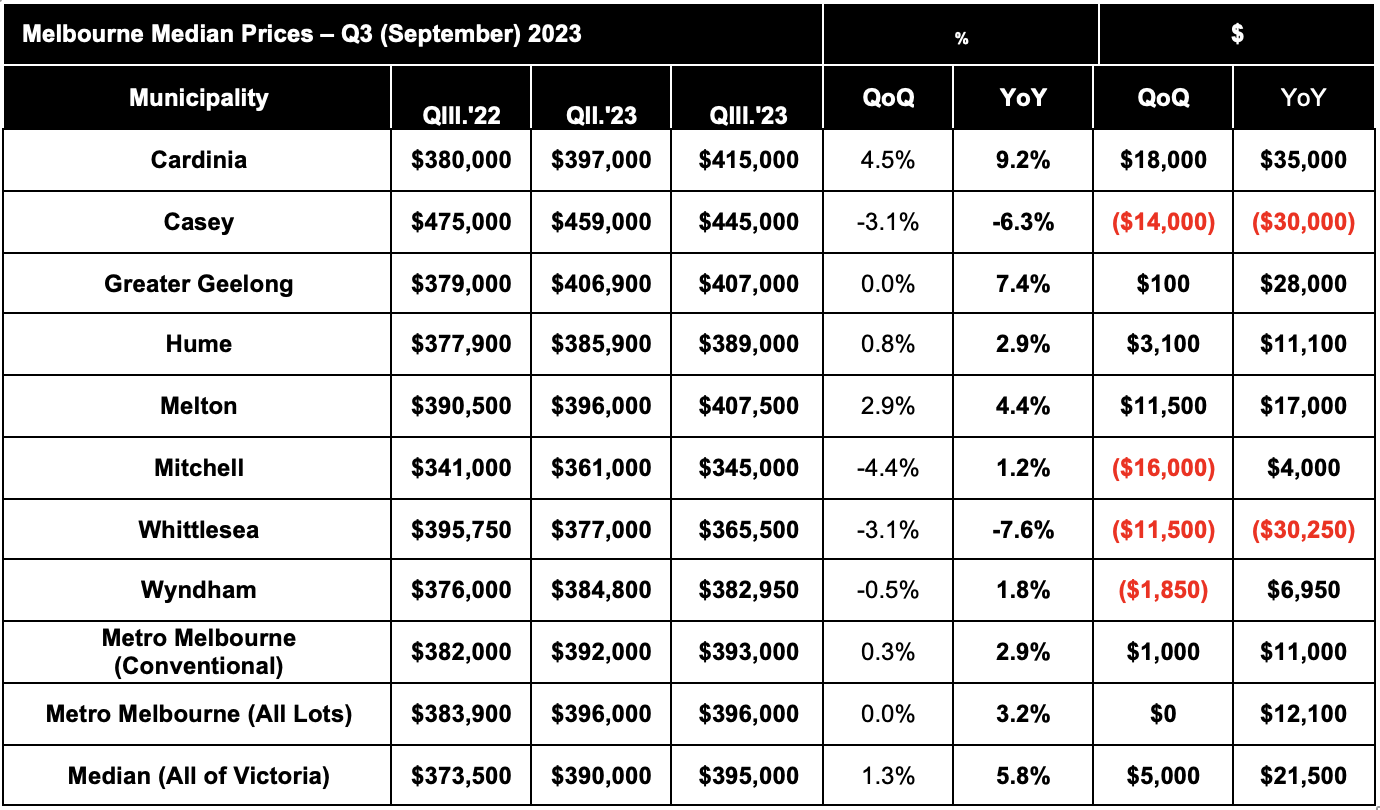

The price for a conventional lot in metropolitan Melbourne increased by just 0.3%, or $1,000, to $393,000 in the three months to the end of September, taking the full-year growth to 2.9% or $11,000.

Oliver Hume's latest Quarterly Market Insights (QMI) report for the three months to the end of September showed higher interest rates and cost of living pressures were continuing to impact sales volumes, with developers increasingly using rebates and incentives to close sales.

While gross prices climbed the widespread use of developer rebates and incentives means the net price actually paid by buyers was likely lower than the previous quarter.

Oliver Hume is one of Australia’s leading residential property funds and real estate services groups and provides a range of research, marketing sales and management services to the property industry. The company’s QMI report tracks thousands of land sales across Victoria with over 2,000 sales reported in the September quarter.

It was a mixed bag across the combined Melbourne and Geelong market with four municipalities recording price increases over the quarter while four recorded a decline. Cardinia was the biggest gainer, adding 4.5% for the quarter to reach $415,000 (up 9.2% over the year). Whittlesea declined by 3.1% over the quarter to reach $365,500 (down 7.6% over the year).

Oliver Hume Chief Executive Officer Project Marketing Julian Coppini said volumes had begun to improve, but remain very low compared to historical averages, with buyers still taking a cautious approach to interest rates and the economic outlook.

“Strong population growth, housing shortages and pent-up demand are helping to underpin demand, but it will take a while until we can declare a recovery,” he said. “The ongoing rebound in the established property market and property price increases is also driving a little bit of a rebound in sale volumes and hopefully, this can be maintained.

“We are seeing developers increasingly use incentives and rebates to get deals over the line, which is also propping up (gross) prices,” he said.

“Upgraders and downgraders, especially second home buyers, account for most of the demand with first home buyers continuing to face significant pressure due to serviceability and affordability challenges.”

Oliver Hume Head of National Research George Bougias said that, following continued price growth and interest rate increases, prices were likely to soften over the next year as developers wound back incentives and rebates and unemployment edged higher.

“However, growing pent-up demand underpinned by record population growth should see volumes and overall market activity continue to climb steadily in 2024 before a more sustained upswing 2025. Interest rates are likely to have peaked in 2024 with the RBA moving to ease monetary policy sometime in the year,” he said.

“We expect 2024 to be a year of transition as the market finds a new normal and overcomes recent challenges. We can expect a return to a period of more normal levels of activity in 2025 as market fundamentals, such as strong underlying demand and growing housing shortages, become increasingly important.”