Retirement Living platform, Aura Holdings to broaden its capital base to grow its portfolio to 2000+ apartments

Contact

Retirement Living platform, Aura Holdings to broaden its capital base to grow its portfolio to 2000+ apartments

Long-term partnership opportunity to invest in Australia’s Retirement Living sector which continues to be underpinned by strong demographic tailwinds.

Since establishing itself as Aura Holdings in 2016, founders Tim Russell and Mark Taylor have developed a market leading retirement living platform which has become known for its high-quality retirement living product in South East Queensland, Australia.

Given the strong demographic trends underpinning the sector and the opportunity for material growth of the platform, Aura is seeking a strategic, long-term partner who can help accelerate the company’s development.

Headquartered in Brisbane, Aura is jointly owned by founders Tim Russell and Mark Taylor. Tim and Mark have a combined 40 years’ experience in the retirement living sector and were previously responsible for running RetireAustralia, Australia’s largest privately owned retirement village operator.

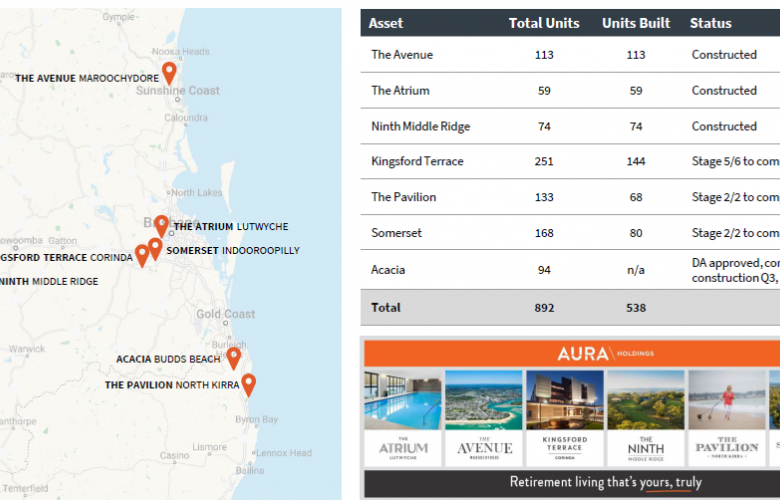

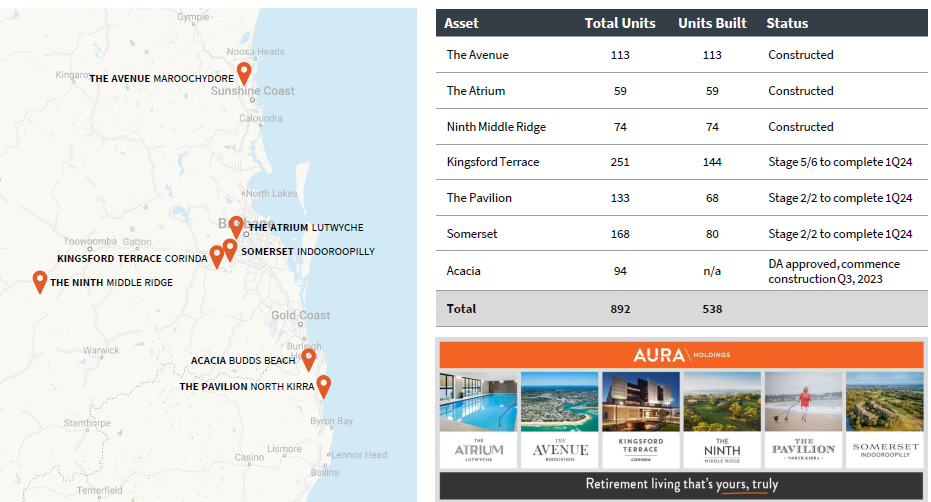

Aura currently operates seven retirement villages incorporating 892 independent living units (on completion). Aura also has an identified pipeline of significant growth opportunities and is therefore seeking to broaden its capital base to coinvest on future projects alongside their existing funding partner, SC Capital Partners.

Aura’s strategic focus is on medium to high end retirement communities in high median house price markets where there is an undersupply of seniors living product. Aura purposely targets only these locations as there is significant equity in the residential home which can be unlocked with a move into seniors living and which provides resilience against the broader residential market. (Full list of current assets below.)

JLL’s Head of Equity Advisory - Australia, Luke Prokuda said, “Tim and Mark have done an incredible job creating a market leading brand and platform in the retirement living sector. The business is in growth mode, with an identified development pipeline to grow the portfolio to 2,000+ units over the next 5 years.

“There is significant potential to grow the scale of the Aura platform given Australia’s retirement living sector is underpinned by compelling demographic tailwinds, low penetration rates, a wealthy target demographic and strong risk adjusted returns relative to traditional real estate sectors.”

JLL Research shows demographic trends remain strong for the retirement sector, with Australia’s 65+ age cohort expected to comprise 23% of Australia’s population in 2061, up from 16% in 2020, which should drive organic demand for retirement living product.

Furthermore, structural shifts in demand via higher penetration rates are expected, as higher quality product is delivered to the market and macro demographic trends (wealth impacts, affordability, convenience, lifestyle) improve the appeal of the retirement living sector.

Aura Co-Founder, Tim Russell said, “Mark and I are excited with and committed to the opportunity to grow the portfolio to 2,000 apartments over the next several years.”

The Aura portfolio is located across South East Queensland, and includes 538 apartments built, with 201 currently under construction.

Related Reading:

JLL advises Elanor on healthcare fund recapitalisation A$289 million

Centuria Healthcare Portfolio for sale $140m by JLL and Cushman & Wakefield | Commo.

New Gisborne Aged Care Home Sold for Circa $24,000,000 CBRE