RPM SEQ Property Research Report revealed SEQ buyers waiting 208 days after signing a contract to settle on residential lots

Contact

RPM SEQ Property Research Report revealed SEQ buyers waiting 208 days after signing a contract to settle on residential lots

This is more than double the median of 96 days buyers had to wait in 2021 and more than three times the 67 days it took to settle land purchases in 2020. Despite record construction activity across the state, southeast Queensland is failing to keep up with demand for residential lots,” said Managing Director of RPM Group QLD, Clinton Trezise.

A new research report has exposed the serious housing challenge facing southeast Queensland amid the interstate migration boom and labour shortages, with the time it takes the industry to deliver new lots to the market more than tripling in less than two years.

The RPM SEQ Property Research Report has revealed property buyers are waiting 208 days after signing a contract to settle on residential lots.

This is more than double the median of 96 days buyers had to wait in 2021 and more than three times the 67 days it took to settle land purchases in 2020.

The RPM report shows that despite construction in Queensland approaching the record levels of 2016, with 40,290 dwellings currently under construction, the release of registered land lots was falling short of market expectation in keeping up with demand, remaining well below average.

Southeast Queensland recorded 17,583 lot registrations in the 12 months to December last year, a figure that comprises urban and large-lot residential land, as well as unit lots. This is well down from the peak of 31,545 in 2017 as the figures have been falling steadily every year since then.

“Despite record construction activity across the state, southeast Queensland is failing to keep up with demand for residential lots,” said Managing Director of RPM Group QLD, Clinton Trezise.

“This is partly due to the combined impact of sustained demand, material shortages and labour constraints. However, the key issue remains a shortage of development sites coming to the market in high demand areas.”

The RPM report shows that southeast Queensland’s indicative land supply appears robust, with a combined 29,208ha of broadhectare sites earmarked for the development of 399,130 dwellings.

Logan and Ipswich have the lion’s shares of this land. Together, these two areas account for more than half of the southeast’s combined dwelling yield.

However, Sunshine Coast and Gold Coast, the lifestyle markets that are among the most in demand by interstate buyers, have about 1,700ha of broadhectare sites each that could be developed to yield 27, 434 and 56,497 residences respectively. These markets together account for just over 21 per cent of the combined dwelling yield.

In a breakdown of suburbs, the RPM report reveals that Logan Reserve and Crestmead in Logan had the highest percentage of interstate buyers in 2022, accounting for 42.66 per cent and 33.86 per cent of sales respectively. Noosa came a close third, with 33.2 per cent of sales to interstate buyers.

However, the iconic Gold Coast beachside suburb of Surfers Paradise topped the list by number with 468 interstate sales recorded, accounting for 23 per cent of the suburb’s total of 2,000 sales for the year. This was followed by 218 at Broadbeach, representing 29.34 per cent of the total 743 sales.

The RPM report also lays bare the pressure on the rental market amid the southeast’s population boom with data showing a significant decrease in the number of bonds held by the Rental Tenancies Authority over the past year.

Brisbane was the only local government area to record an increase in bonds, which indicates more dwellings entered the rental pool during the year.

The biggest falls in percentage terms were recorded in Somerset and the Lockyer Valley, at 12 per cent and 7 per cent respectively.

However, the Gold Coast led the charge by number with a massive 3,469 fewer rental bonds for the 12 months to the end of December – a fall of 4 per cent.

Sunshine Coast had 1,502 fewer rental bonds, down 5 per cent, while Moreton Bay bonds were down by 1,500, or 3 per cent.

“These decreases have obviously had a knock-on effect on average rents across the region,” said Mr Trezise.

Rents on the Gold Coast and Moreton Bay have increased by 19 per cent across all dwellings. And while vacancy rates across the state eased slightly in December, the most recent quarter’s data found that that there were 6,758 fewer bonds held across southeast Queensland than the same time last year.

“The combined data clearly shows the real pressure points for the property market as Queensland faces unprecedented demand led by record interstate arrivals,” said Managing Director of RPM Group QLD, Peter Neale.

“At the heart of the issue is the availability of land which is not translating into adequate stock that is ready to build on, meaning that southeast Queensland is falling well behind in meeting the needs of a booming market.”

Queensland recorded 55,418 interstate arrivals over the 12 months leading up to June 2022, the most of any state, with the majority of those arrivals settling in the southeast corner.

“While Queensland interstate migration isn’t forecast to continue at the same accelerated rates as we saw post-COVID, it is expected to outpace other states,” said Mr Neale.

“The most recent government forecasts predict the state to gain an additional 766,000 new residents by the 2032-33 financial year.”

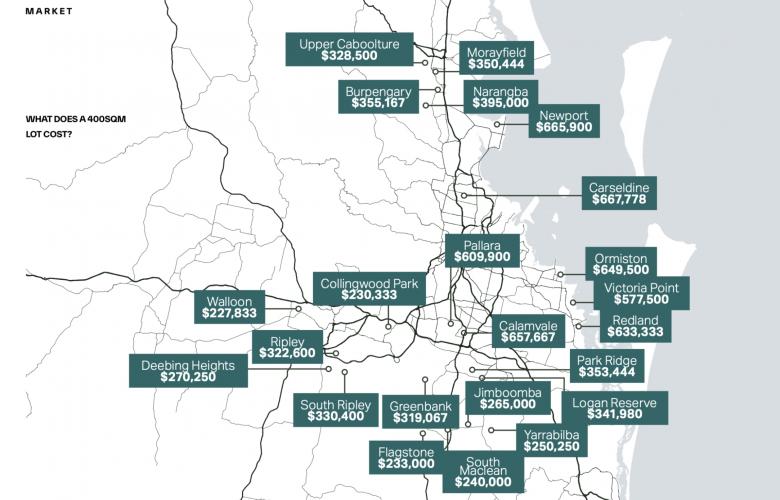

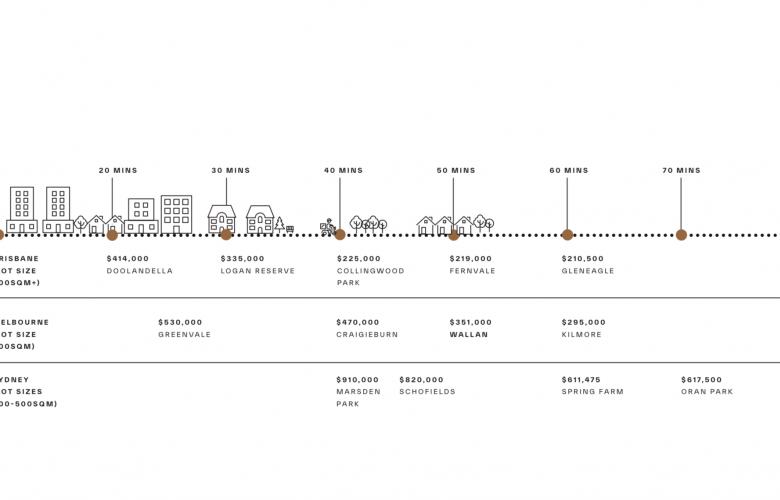

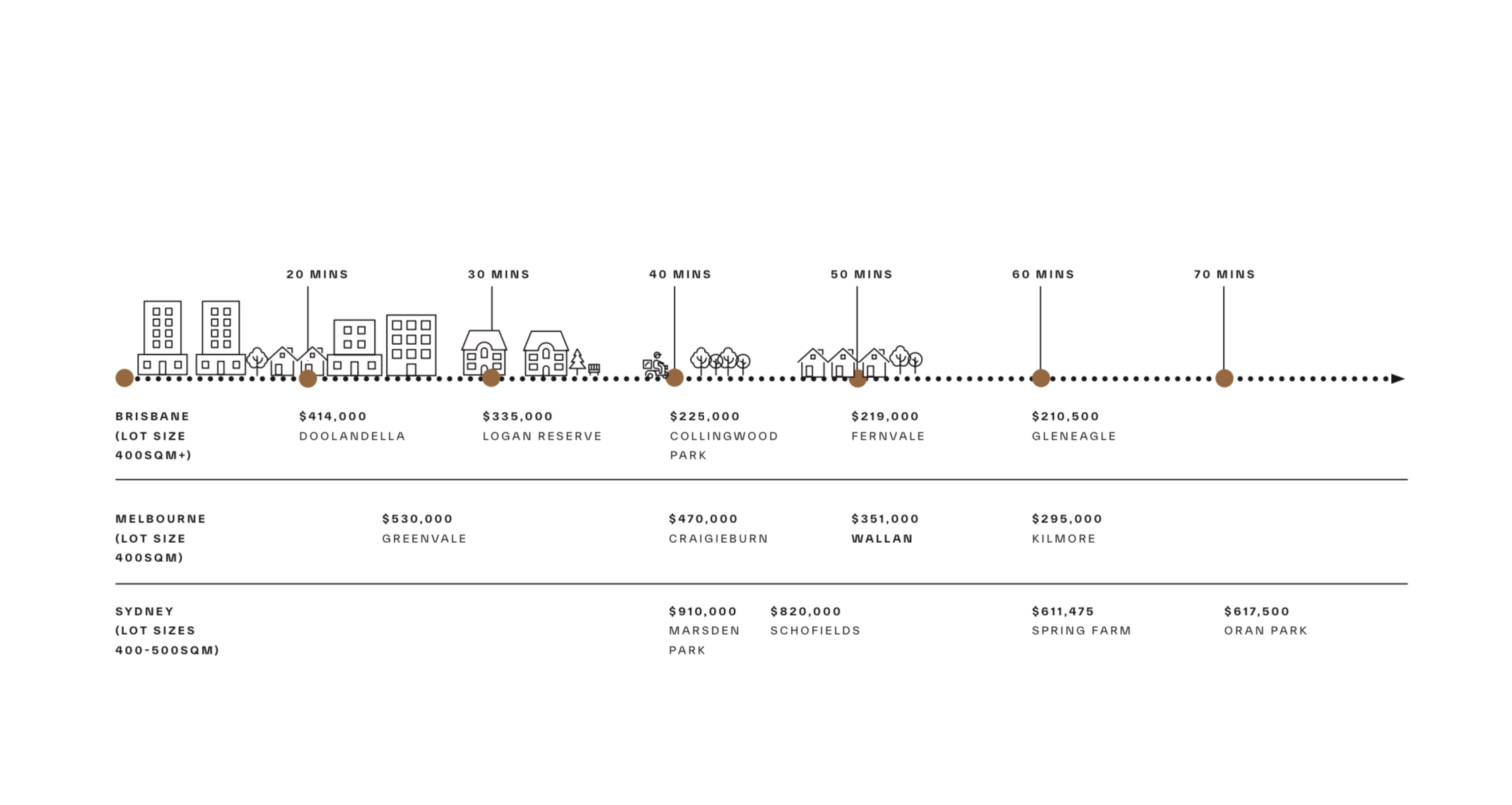

The RPM report shows that affordability remains a key attraction for interstate buyers with the cheapest land closest to Brisbane located at Doolandella (average price $414,000), located just 20 minutes from the city, followed by Logan Reserve ($335,000) which is 30 minutes from the city.

The cheapest land closest to the Melbourne CBD is $530,000 at Greenvale which is under 30 minutes from the city, while in Sydney lots at Marsden Park, 40 minutes from the city, are averaging $910,000.

However, the RPM report notes that, at the current rate of land releases, southeast Queensland will struggle to meet the estimated 30,640 new dwellings a year needed to cater for the expected population growth.

“Amid the ongoing capacity constraints, there is clearly a need for statutory bodies to release more land to ease the pressure on buyers,” said Mr Trezise.

“The solution also rests with making provisions to fast-track developments in areas that are deemed suitable for residential dwellings within the urban footprint.”

Related Reading:

SIG Group acquires 42ha Ripley site from Sekisui House Australia

RPM SEQ Property Research Report revealed SEQ buyers waiting 208 days after signing a contract to settle on residential lots