Developer focus on owner-occupied stock to further pressure rental market - Knight Frank Residential Developer Survey 2023

Contact

Developer focus on owner-occupied stock to further pressure rental market - Knight Frank Residential Developer Survey 2023

Knight Frank has released its Australian Residential Developer Survey 2023, which is the first of its kind. Knight Frank Partner, Head of Residential Erin van Tuil said more developers were opting for a balanced buyer pool or homes designed purely for an owner-occupier.

A diminished pipeline of new homes targeted to investors will put further pressure on an already stretched rental market, according to the latest research from Knight Frank.

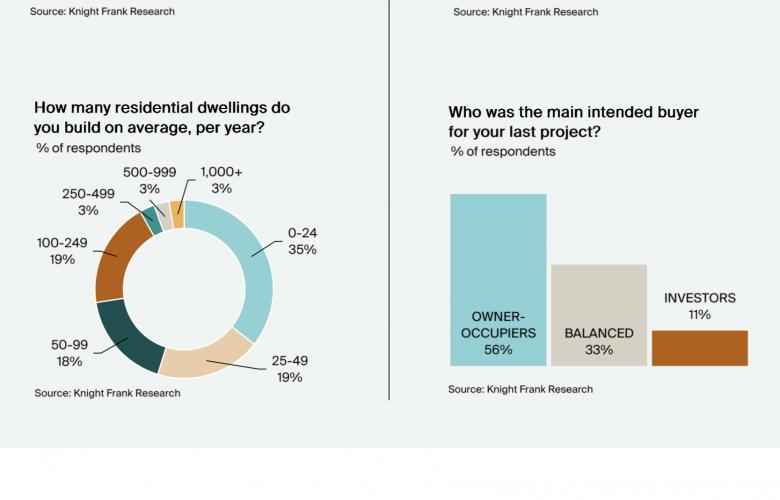

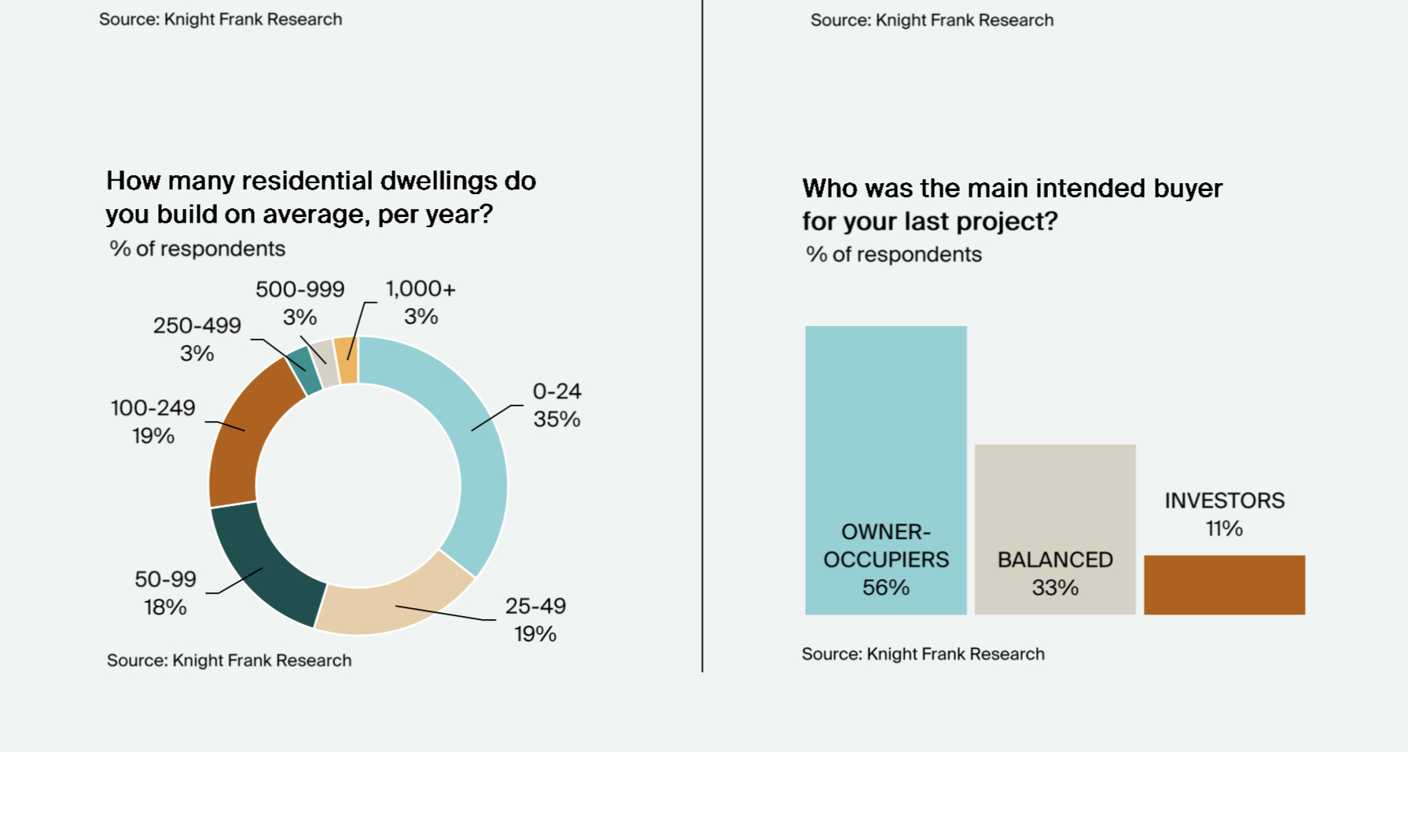

The Australian Residential Developer Survey 2023, which surveyed the views of 70 developers at the end of last year, found there was a focus on building owner-occupied stock, with 56 per cent of respondents saying owner-occupiers were the main intended buyers for their last project.

This was compared to just 11 per cent focused on investors and 33 per cent being a balance between the two buyer types.

Moving forward there will be a growing focus on owner-occupiers, with 58 per cent respondents indicating they would target owner-occupiers for their next project, with only eight per cent targeting investors solely, while 34 per cent would be balanced.

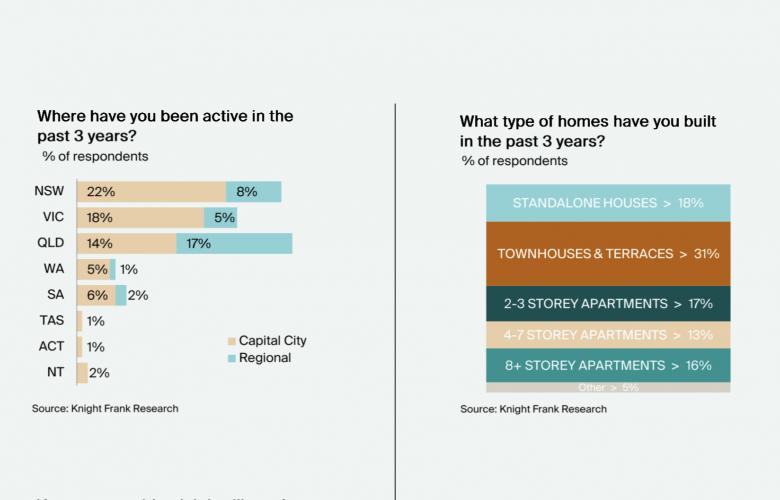

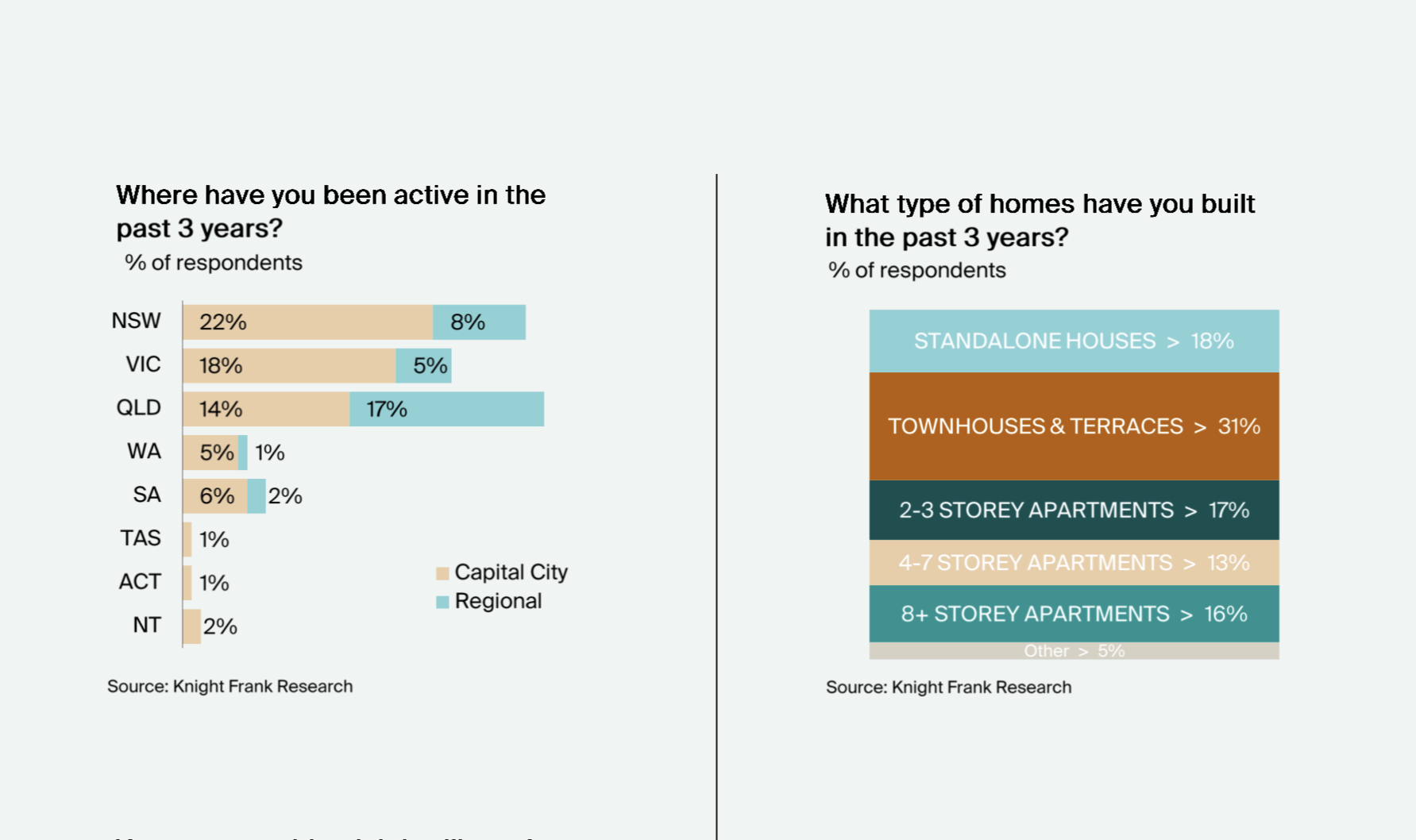

According to the results of the survey, which is the first of its kind undertaken in Australia by Knight Frank, the major focus for developers is townhouses and terrace homes, with 31 per cent indicating they have built this type of housing over the past three years, compared to 18 per cent for standalone houses and a total of 46 per cent for apartments.

Moving forward, 35 per cent of respondents indicated they would build townhouses and terraces, followed by standalone houses (18 per cent), and 45 per cent apartments.

Knight Frank Partner, Head of Residential Erin van Tuil said more developers were opting for a balanced buyer pool or homes designed purely for an owner-occupier.

“Many owner-occupiers are looking to move from a standalone house to a townhouse or terrace home to downsize or rightsize,” she said.

“COVID put the spotlight on how we are living as being stuck at home during lockdown gave people the time to reflect on their lifestyles, with these downsizing or rightsizing buyers now looking for more generously sized townhouses or apartments, but with impressive amenities to provide convenience and luxury.”

Knight Frank Partner, Head of Residential Research Michelle Ciesielski said the supply of new homes continued to be constrained for most Australian capital cities, which was directly impacting the current low rental vacancy rates and leading to high rental growth.

“There will continue to be significant pressure for the rental market with fewer new dwellings being designed for investor buyers to add to the rental pool, coupled with other issues for investors such as recent higher investor mortgage lending rates.

“Aside from developers exploring a hybrid, build-to-rent model for responding to the rental crisis, the incentive for developers to build more investor stock is limited.

“There is also the further challenge with affordability, with 52 per cent of developers surveyed saying the cost of living crisis is having a significant impact overall on buyer sentiment.

“However, as migration picks up the pace over the next two years, there will be more demand for rental stock, which will lead to a greater undersupply, pushing up rents even further.”

The Knight Frank survey found the construction pipeline for apartments in particular would fall over the coming two years in the three main capitals of Sydney, Melbourne and Brisbane.

The overwhelming majority of respondents to the Knight Frank survey flagged concerns around the availability of suitable development land for the future, with 79 per cent of developers surveyed saying land was ‘limited’ or ‘very limited’.

Nine in 10 developers also said the impact from planning regulations was causing a barrier for the delivery of future housing supply, with half the respondents now believing a site with development approval is ideal for their next purchase.

However, planning delays are expected to be the big challenge this year, with 15 per cent of developers naming this as the number one issue expected to have an impact on residential development in 2023.

This was followed by buyer sentiment, material costs and availability, labour costs, the local economic outlook, construction delays, availability of land, viability of development finance, skills and labour availability and mortgage availability and cost.