Operational residential investment showing 'strong fundamentals' in 2020 - Savills report

Contact

Operational residential investment showing 'strong fundamentals' in 2020 - Savills report

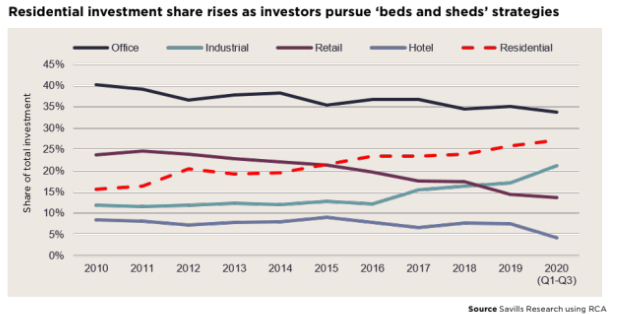

Operational residential investment (which comprises multifamily, student housing and senior living assets) accounted for 27 per cent of global real estate investment in the first three quarters of 2020, up from just 16 per cent a decade ago, according to the Savills Global Living 2020 report.

Demographic trends and affordability constraints are continuing to drive demand for rental accommodation across the globe, contributing to the resilience of the operational residential investment sector, new research has found.

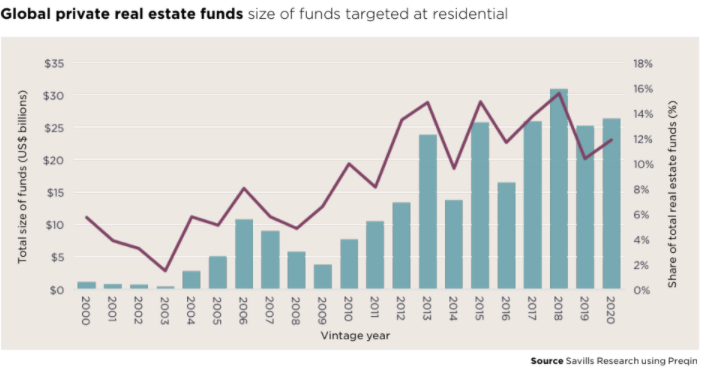

The Savills Global Living 2020 report revealed capital targeted at the sector from funds had risen by 60 per cent in the last four years, from $16.4bn in 2016 to $26.3bn in 2020 (Preqin).

According to the report, investment volumes in the sector for first three quarters of this year were down 31 per cent - the least dramatic fall alongside logistics (-16 per cent), compared with offices (-37 per cent) and retail (-38 per cent) when benchmarked with the same period in 2019.

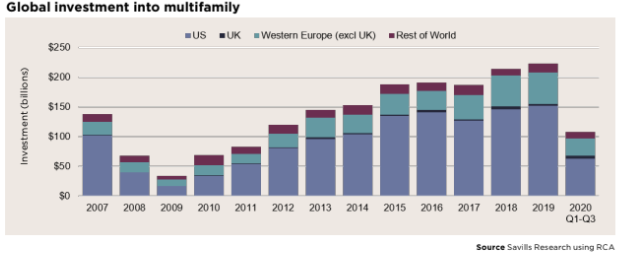

The figures come after a record year in 2019 when a total of $297bn was invested into the sector.

Savills Australia Student Accommodation Director Paul Savitz said the operational residential sector, which comprises multifamily, student housing and senior living assets, had held up better than some others this year due to investment activity being largely driven by the consolidation of companies across the relevant sub-sectors.

“Despite the near-term effects of the pandemic from a macro-economic point-of-view, the longer-term growth in capital volumes targeting operational residential assets speaks for itself," he said.

"Investors are not only seeking to diversify their real estate portfolios but are looking for those stable income-streams for which the sector has become so renowned.”

The report shows that cross border investment into the operational residential sector has also grown, now standing at $46bn (Q4 2019-Q3 2020) and accounting for 22 per cent of total investment into residential.

This is up from the 14 per cent that cross-border deals accounted for just four years ago in 2016.

More investment activity to come

Mr Savitz said while the multifamily market was "relatively nascent" in Australia, Savills data showed the sector in Australia is on track to deliver 10,000+ multifamily apartments nationally by 2023, with the completion of 45,000 apartments projected by end of 2028, which was on par with the trajectory of completions that the UK market witnessed.

"It is expected that as federal and state governments adapt rules pertaining to tax and planning in order to make investment into the sector more attractive, investment volumes will begin to match Western European countries by 2025," he said.

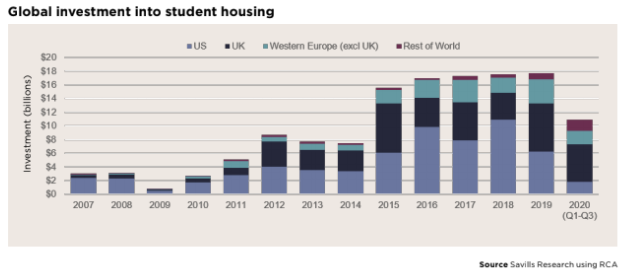

Conal Newland, National Director Student Accommodation, said student housing had also proved its resilience despite the headwinds brought about by Covid-19, such as the disrupted school and university terms.

"Like multifamily globally, consolidation has been a key driver in the student housing sector in Australia, which has recorded record investment volumes for 2020, which are forecast to total $3.1bn, an increase of 115 per cent on 2019 levels," he said.

M3 Capital Partners sold Urbanest Australia Purpose Built Student Accommodation (PBSA) platform to Scape earlier this year. Source: Urbanest

"This year has seen some truly impressive transactions in the operational residential sector, cementing it as one of the most favourable asset classes.

"With the long-term picture showing an uptick in global mobility, we expect significant opportunities to remain for investors wishing to diversify their real estate portfolios.

“While there is no shortage of capital targeting the sector, the challenge (and opportunity) in Australia, at least, is finding prime development sites, completed assets or conversion prospects in which to invest.”

What next?

With yield compression increasing as the maturity of the sector becomes more apparent, the report shows multifamily yields are now stabilising in most markets following a significant inward yield shift trend over the past five years.

Savills believes the lending market is in a much stronger place compared to the global financial crisis (GFC) as a result of rapid intervention by central banks, which has supported liquidity.

The research forecasts residential to remain a favourable asset class to lend against, thanks to the sector’s long-term fundamentals.

Click here to download a copy of the report.

Similar to this:

Largest ever student accommodation transaction in Australia completes for $2.1bn+ Savills

Australia's build-to-rent sector 'accelerated' by impact of pandemic - Savills