Top 10 trends in residential development for 2020: Knight Frank

Contact

Top 10 trends in residential development for 2020: Knight Frank

Knight Frank has listed the latest residential trends in their report Australian Residential Development Review 2020.

According to Knight Frank's Australian Residential Developent Review, the residential market was gaining momentum across most Australian cities heading into 2020, following the strengthened global economy and a relaxed local lending environment improving the residential development outlook.

As the new year commenced, the world began to grapple with the health crisis surrounding the coronavirus pandemic and economic certainty ahead.

In October 2019, the International Monetary Fund (IMF) had forecast the Australian economy to grow by 2.3 per cent in 2020.

At a Glance:

- October 2019, the IMF forecast the Australian economy to grow by 2.3 per cent in 2020 but by April it was revised to contract by 6.7 per cent

- Forecast to recover strongly in 2021, with 6.1 per cent growth expected

- There will be 27 per cent less new apartments to be built in 2020-23 compared to 2016-19

By April, the IMF had revised the outlook for Australia to contract by 6.7 per cent in 2020 before recovering strongly in 2021, with 6.1 per cent growth expected.

With this has been some changing trends across Australian cities.

These are 10 residential development trends to monitor over the coming year according to the Australian Residential Development Review 2020:

1. High-density sites continue to dominate total sales

Developers and investors purchased a total $4.04 billion of development sites across Australia in 2019, down 21.5% on the previous year. Towards the end of 2019, it was becoming less difficult for developers to obtain local finance although it's expected this may become challenging once again as the months progress in 2020.

Dividing the total sales volume by density found sites suitable for high-density development recorded a 70.6% share in 2019, increasing from 67.9% in 2018, reflecting the ongoing demand for low-maintenance living.

2. Less offshore developers buying sites

With the exception of Greater Brisbane, all major cities saw less residential sites purchased by offshore developers, by value, between 2018 and 2019. Greater Melbourne (43.7 per cent) saw the highest share of offshore buyers over this time.

In Knight Frank's The Wealth Report 2020 Attitudes Survey, wealth advisors were asked which sectors were becoming of more interest to their clients (worth US$30m+). Almost 68 per cent of Australian clients saw development land as an opportunity, trending above the global average of 62 per cent.

3. Pressure on build costs and delivery

Construction workers were deemed an essential service in the lockdown, so work sites continued to operate with forced physical distancing. Although construction starts have slowed, it's likely the first ripples in the supply chain from the coronavirus impact will start to emerge from local and offshore raw materials, to warehousing and transport.

Across Australia, the cost of construction rose 2.7 per cent in 2019, with Melbourne recording the highest increase of 4.3 per cent, followed by Canberra with 4 per cent.

4. Housing pipeline tapers while the average block of land increases

Newly released land for single dwellings was down 25 per cent in 2019 totalling 35,740 lots across the major Australian cities.

Melbourne saw the most released with 11,964 land lots, followed by South East Queensland (8,188) then Perth (6,763).

Bucking the trend over the past decade, the average land lot in Australia actually grew to 421 sqm in 2019, up from 417 sqm a year earlier.

Over this time the weighted average lot price fell by 4.3 per cent to a median value of $306,100.

5. New houses are becoming smaller, while new apartments are larger

The average new Australian house built in 2019, at 229 sqm was 1.3 per cent smaller than a year ago, while the average new apartment size was larger by 3.2 per cent, to 129 sqm, reflecting the recent rightsizing movement.

The largest new houses were built in the Australian Capital Territory (251 sqm) with the smallest in Tasmania (179 sqm). Conversely, Tasmania saw the largest new apartments built (159 sqm) while the smallest were in the Australian Capital Territory (102 sqm).

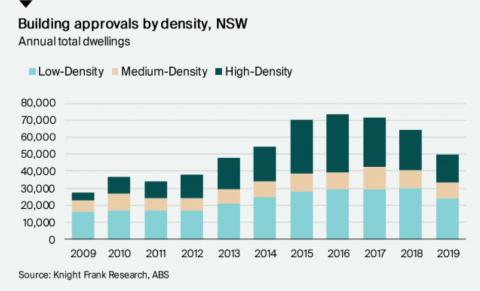

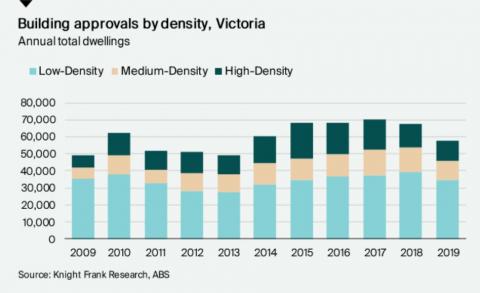

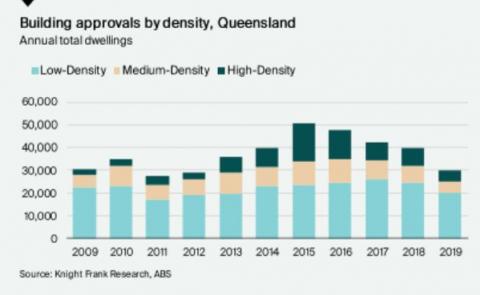

6. Apartment pipeline moderates in coming years

Across the major cities of Sydney, Melbourne and Brisbane, just under 142,800 new high-density apartments are in the pipeline (under construction or being marketed and likely to be built between 2020 and 2023).

This delivery of apartments will be 27.3 per cent less than those completed over the past four years.

7. Projects to reach new heights with more apartments per project

Between 2016 and 2019 across Sydney, newly completed high-density projects averaged nine storeys. From 2020 to 2023, this will rise to 14 storeys for projects in the pipeline.

Between these two times in Melbourne the average new build will grow from 15 storeys to 17 storeys, while in Brisbane average new builds will move from 11 storeys to 13 storeys.

8. Population growth to pause

The new housing pipeline has factored in solid population growth across most of our major cities.

Positive net migration is likely to pause for most of 2020 following the closure of borders through the coronavirus pandemic.

Over the coming year, residential vacancy is likely to move towards, or stay in oversupplied territory, and have a potential reduction in median weekly rents.

However, some comfort comes along the east coast, with a moderated delivery of new housing and apartment supply in the coming years.

9. Attractive currency play for offshore buyers

There is likely to be returned interest from offshore buyers throughout the year with favourable buying conditions against the Australian dollar.

Over recent years, non-residents have been cautious across Australia with the introduction of fees and surcharges when buying residential property.

Changes to the Foreign Investment Review Board (FIRB) in March 2020 may make gaining approval lengthier than expected in the past.

10. Buyers becoming more risk adverse, despite lower borrowing costs

Until the full impact of the coronavirus is established, local buyers have become more risk adverse protecting themselves in the current economic environment.

Many are sitting idle, neither walking away not in a position to be lured by the availability and low costs of mortgage lending.

With the sudden stop in the economy and rising unemployment as a consequence, most markets must be prepared for a price redirection until a potential uplift once again in 2021.

In saying this, those with secured income streams or now in retirement remain active in the market especially when planning to rightsize into the limited product when it becomes available.

You can download the full report of he Australian Residential Development Review 2020 here

Similar to this:

Build-to-rent on the rise in Australia despite 'unique' challenges - report

Shakespeare Group’s $150 million St Boulevard topping out sparks fresh buyer interest

Developers and investors expected to pounce on 18 townhouses for sale in Burleigh Heads