Transparency Index reveals Asia Pacific shows fastest progress - JLL

Contact

Transparency Index reveals Asia Pacific shows fastest progress - JLL

JLL's recent Global Real Estate Transparency Index for 2018 has revealed PropTech stands to boost Singapore, Hong Kong, Japan and China's rankings.

Asia Pacific’s mature economies such as Singapore, Hong Kong and Japan, have a significant opportunity to advance real estate transparency through PropTech adoption.

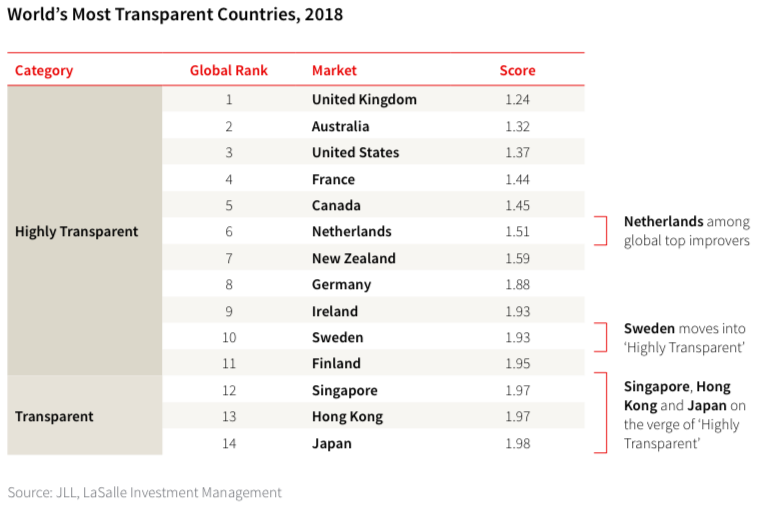

These leading investment destinations are on the cusp of the ‘Highly Transparent’ tier, according to JLL’s Global Real Estate Transparency Index (GRETI) 2018, and are poised to join the top group, which includes countries such as Australia, New Zealand, the U.S. and the UK.

GRETI 2018 at a glance:

- Singapore, Hong Kong and Japan hold top stops in 'Transparent' category at rankings of 12, 13, and 14 respectively.

- PropTech to play role in improving real estate transparency.

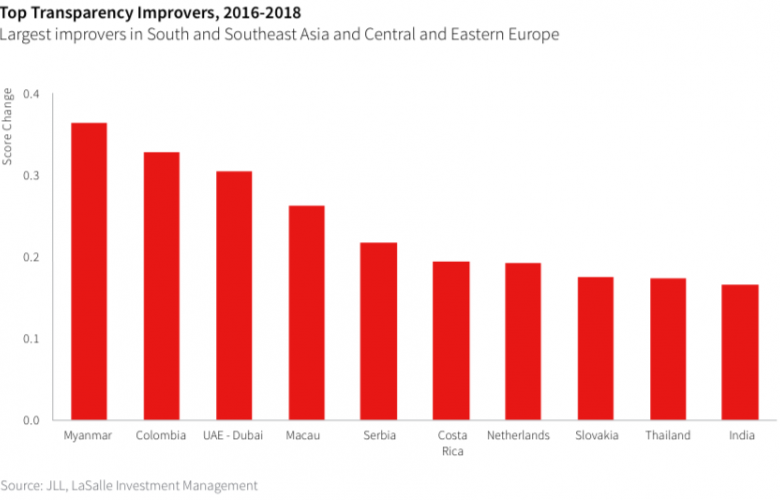

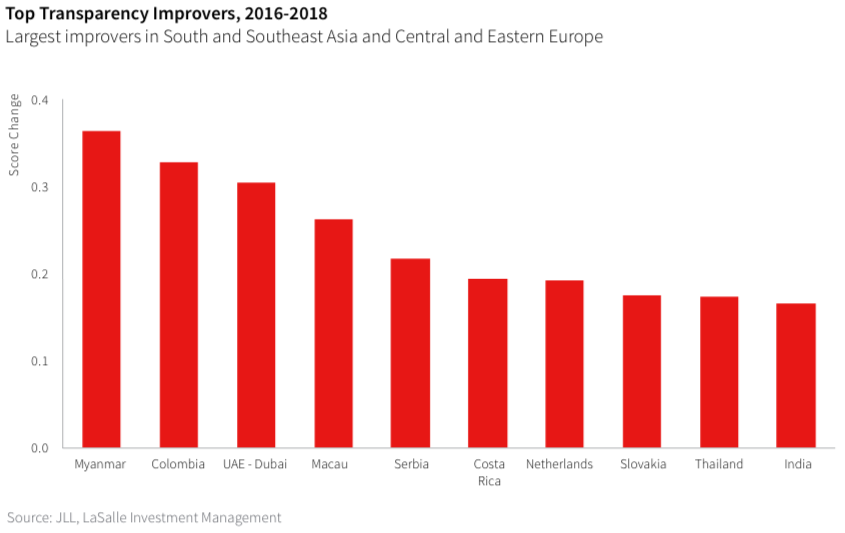

- Myanmar registered most significant improvement globally, moving up 15 places.

- Collectively Asia Pacific performed better than all other regions (Europe, Americas, Middle East/North Africa, Sub-Saharan Africa).

“The PropTech sector is growing fast, especially in Asia, though adoption is still relatively low compared to North America and Europe,” says Jeremy Kelly, Director, Global Research, JLL. “We believe the Singapore government could play a key role in promoting PropTech adoption through open-data initiatives and the pioneering of blockchain technology.”

“The potential benefits of PropTech are certainly not limited to transparent markets,” he adds. “It could also help improve transparency in semi-transparent markets like China, which has a vibrant PropTech sector, and where traditional data sources are lacking.”

Source: JLL, LaSalle Investment Management

Another key area of potential improvement for both Singapore and Hong Kong is in sustainability transparency. Strengthening energy efficiency requirements, carbon reporting and stricter energy consumption disclosure will help them make the step up; and in this regard, they could emulate Japan, which has become a global leader in sustainability transparency.

Biggest improvements in Asia Pacific

“Asia Pacific as a whole has made the strongest transparency improvements since 2016 compared to the other four regions covered by the study,” says Dr Megan Walters, Head of Research, Asia Pacific at JLL. “This is supported by developments in Myanmar, Macau, Thailand, India and South Korea.”

Myanmar has registered the most significant improvement globally, moving up 15 places to join the ‘Low Transparency’ group. According to the report, the country continues to open up its economy as increasing investor demand translates into greater market intelligence.

Source: JLL, LaSalle Investment Management

For the first time, South Korea has nudged into the ‘Transparent’ tier, with heightened investor activity pushing improvements in data coverage and a new carbon emissions trading scheme.

Dr Walters adds: “It’s also worth noting that India’s reform-driven government has made significant progress in its agenda to improve transparency and reduce corruption. The Real Estate Regulatory Act, which was passed in 2016 and implemented in 2017, is a regional highlight. The country joins China, Indonesia and Thailand at the top end of the ‘Semi-Transparent’ tier.”

“Looking to Southeast Asia, Thailand and Vietnam are both moving towards the cusp of the next tier of transparency. Thailand’s improvement is underpinned by greater regulatory enforcement, the planned introduction of a new property tax system and steps to digitise its land registry. Macau has also advanced with a focus on anti-money laundering, resulting in increased monitoring by financial regulators,” says Dr Walters.

Advancing sustainability

Progress has been made on sustainability transparency across the region. South Korea introduced a carbon emissions trading scheme; meanwhile, Vietnam established its own market-specific Green Building Certification System several years ago and is implementing mandatory minimum energy efficiency standards for all new buildings and major retrofits.

Improvements in transparency in some Asian countries have been accompanied by record-breaking commercial real estate investment volumes. In 2017, real estate transactions in the Asia Pacific region reached a record US$149 billion.

Click here to view the JLL Global Real Estate Transparency Index 2018.

For more information or to discuss the report, email Jeremy Kelly, Director Global Research Programmes, JLL Singapore via the contact details listed below.

Source: JLL Global Real Estate Transparency Index 2018

Similar to this:

Bangkok ranked 92nd most expensive city

Singapore rents rise with increasing demand and reduced supply - Savills reports