CBRE forecasts strong economic growth for Korea in 2018

Contact

CBRE forecasts strong economic growth for Korea in 2018

CBRE Korea reports on the high-risk high-reward habits of foreign investors in Korea's property market during 2017 and beyond.

CBRE Korea provides an outlook on foreign investment interests and its effects on Korea's property market in the Korea In & Out 2017 Report.

At a glance:

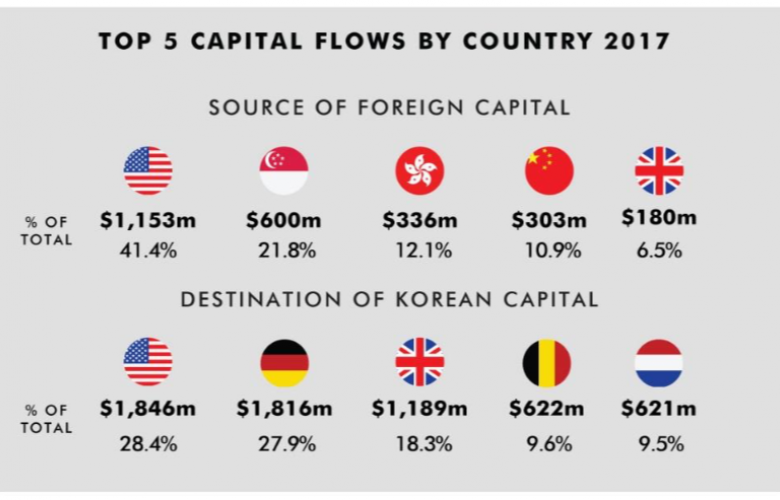

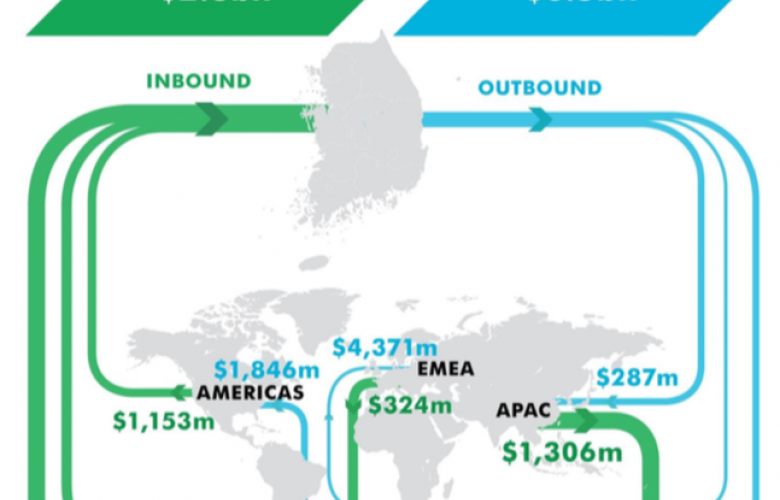

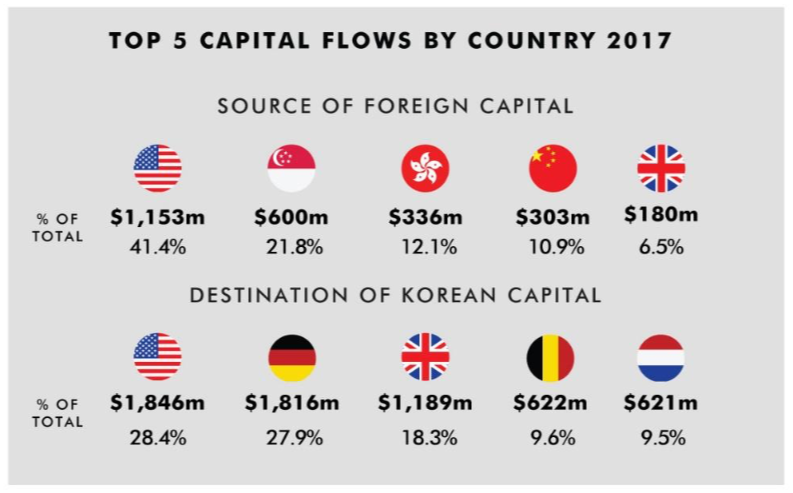

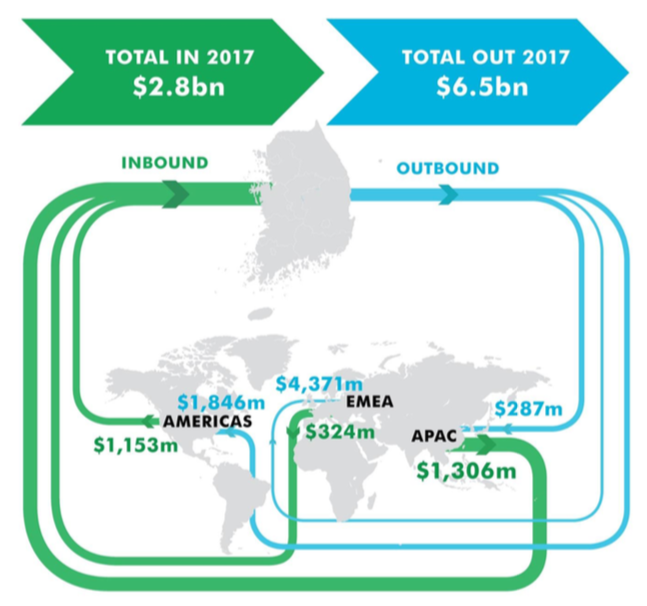

- Foreign investors purchased US$2.8 billion worth of commercial real estate in 2017, a decline of 48.1% y-o-y, due to lack of big ticket deals.

- Despite lower transaction volume, foreign investors retain a strong appetite for Korean property as they seek to diversify their investment portfolios and secure higher returns.

- Of the 26 deals transacted by foreign investors in 2017, the logistics sector accounted for nine transactions worth US$537 million.

- Korean outbound real estate investment has risen by a CAGR of 11.1% over the past five years.

- Fundraising for Korean public real estate funds totalled US$1.4 billion in 2017, representing growth of 53.8% y-o-y.

According to CBRE, foreign investors purchased US$2.8 billion worth of commercial real estate in 2017, a decline of 48.1% y-o-y, caused by a lack of big ticket deals. Despite the lower transaction volume, foreign investors have retained a strong interest in Korean property as they look to diversify their investment portfolios and secure higher returns in comparison to other Asia Pacific markets. The logistics sector accounted for nine out of the total 26 transactions conducted by foreign investors in 2017, worth US$537 million.

Source: CBRE Korea In & Out 2017 Report

While local investors tend to focus on assets with minimal vacancy risk, overseas purchasers are willing to pursue value-added opportunities and pay relatively lower prices for office buildings with existing vacancy or properties where active asset management strategies can be implemented.

CBRE expects solid economic growth as a result of the easing geopolitical tension with North Korea to attract a steady flow of foreign capital in 2018.

Over the past five years, Korean outbound real estate investment has risen by a Compound Annual Growth Rate (CAGR) of 11.1%. Investors are demonstrating a strong preference for office assets in major markets, with such deals accounting for 88% of total outbound investment volume in 2017. Other key criteria include assets with guaranteed long-term master leases and properties located in markets with strong fundamentals and solid leasing demand.

Source: CBRE Korea In & Out 2017 Report

Claire Choi, Head of Research for CBRE Korea said, “While we have witnessed quite impressive footprints by foreign capitals in the Korea investment market, more local investors are continuously looking to invest in overseas markets like Europe or North America. This is not to say that domestic investors are weaker in the local market, but they are more aggressively looking at outbound investment opportunities as well to seek stable assets.”

CBRE suggests the factors driving overseas investment include the intense competition for assets in Korea and the availability of higher returns in markets such as the U.S. and Europe. Recent years have seen some Korean investors expand their footprint from primary markets in these regions to secondary locations where returns are even higher.

Although Korean outbound real estate investment continues to be dominated by institutional investors, 2017 saw a number of asset managers setting up real estate funds targeting High Net Worth Individuals (HNWI), many of whom are keen to increase their indirect exposure to an overseas real estate market. Fundraising for Korean public real estate funds totalled US$1.4 billion in 2017, representing a growth of 53.8% y-o-y. CBRE Research expects stricter domestic residential investment regulations to encourage further investment in real estate funds by Korean HNWIs in 2018.

For more information or to discuss the report email Claire Choi of CBRE Korea via the contact details listed below.

Similar to this:

South Korea sees active transaction volume for Q1 2018 - CBRE South Korea's MarketView Report

Southeast Asian cities dominate as top investment destinations in JLL report