Singapore sees low key sales and launches in February due to festive month

Contact

Singapore sees low key sales and launches in February due to festive month

Mr. Ong Teck Hui, National Director of Research & Consultancy at JLL reports on the private residential units sold by developers in February 2018.

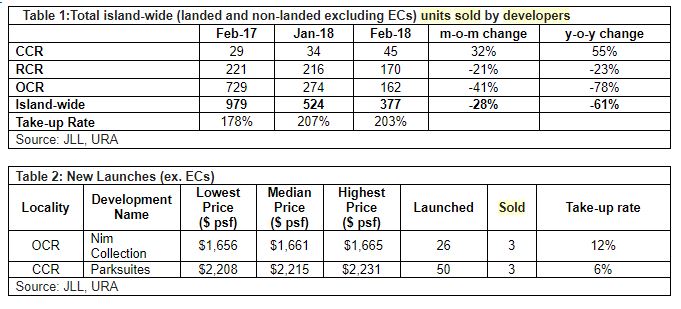

Developers sold 377 private residential units in February, 28.1 per cent lower than in January 2018, and also a drop of 61.5 per cent y-o-y. Launches also declined, with 186 units placed on the market, 26.5 per cent lower than the previous month and a decline of 66.2 per cent from the 550 units launched in February 2017.

The two fresh launches in February were Parksuites at Holland Grove and Nim Collection, a landed development at Nim Rise. Of the 119 units in Parksuites, 50 were launched and 3 sold at a median price of $2,215 psf. The 98-unit Nim Collection placed 26 units on the market, selling 3 terrace units at a median land price of $1,661 psf.

The top selling private residential projects for February were:

- Queens Peak (47 units at a median price of $1,730 psf)

- Kingsford Waterbay (34 units at median price of $1,349 psf)

- Artra (30 units at median price of $1,726 psf)

- Grandeur Park Residences (26 units at a median price of $1,487 psf)

- Parc Botannia (19 units at median price of $1,250 psf)

New executive condominium (EC) sales:

EC sales fell to 92 units in February slightly less than the 100 units sold in the previous month. Top selling EC projects in February were:

- Parc Life (24 units at a median price of $836 psf)

- Signature at Yishun (23 units at a median price of $806 psf)

- The Criterion (16 units at a median price of $785 psf)

- Northwave (15 units at a median price of $788 psf)

Mr. Ong Teck Hui, National Director of Research & Consultancy at JLL commented: “If we compare February 2018 with January 2017, both Lunar New Year months, there is some similarity in the low key launches and sales. 186 units were launched in February 2018 with 377 units taken up versus 108 units launched and 382 units sold in January 2017 respectively. So the low key performance in February is not indicative of a market slow down.

Notwithstanding the festive period in February and the dearth of new launches, buyers were still house-hunting among previously launched projects, resulting in sales from these accounting for 98.4 per cent of total new private home sales during the month. This is indicative of ongoing interest among home buyers. Both launches and sales of new private homes are expected to pick up from March, as developers resume project sales and more buyers return to the market after the festive lull.

However, the low sales of new ECs at 92 units in February was due to an almost depleted supply of unsold ECs. Excluding Rivercove Residences, which is yet to be launched, there were only 212 unsold EC units in projects under marketing. This is only a small fraction of the 2,514 units unsold in EC projects under marketing one year ago. Consequently, new EC launches are expected to be priced optimistically. The severe under-supply of ECs also contributed to the recent bullish top bid of $583 psf/pr for the Sumang Walk EC site, which would result in a break-even cost of about $1,000 psf.”

Source: JLL

Similar to this:

Signs of a Singapore pick-up notwithstanding usual slower sales in January