"Vietnam remains one of the most favourable destinations for foreign investment in South East Asia."

Contact

"Vietnam remains one of the most favourable destinations for foreign investment in South East Asia."

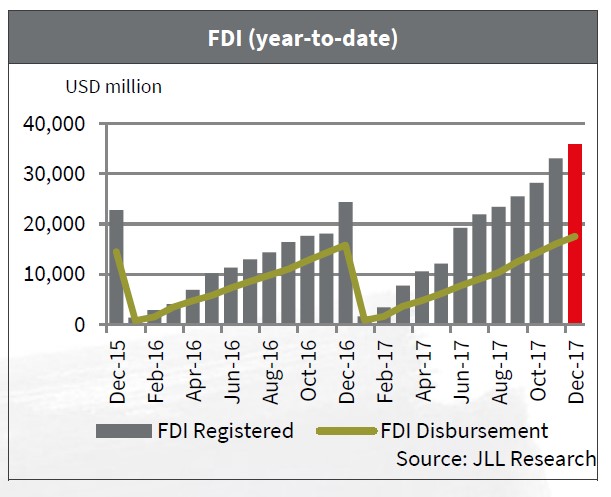

FDI hit a new record in 2017 at nearly US$35.9 million, representing a 44.4% increase compared to the previous year according to Phuong Le, Investment Analyst, Capital Markets, Vietnam, JLL.

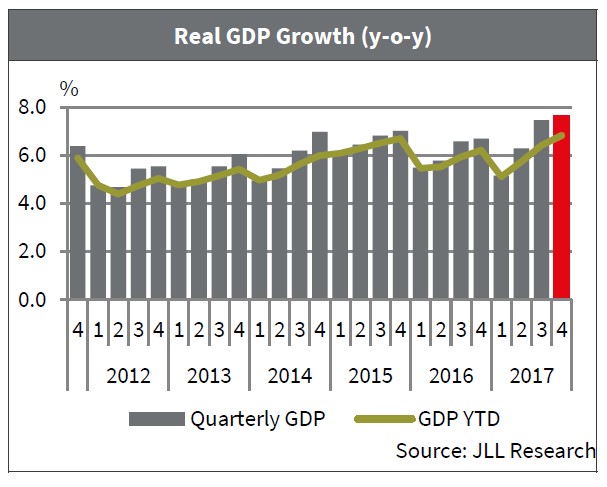

In 2017, the Vietnam economy continues to experience strong growth. By the end of the fourth quarter Vietnam’s GDP reached 6.8%, outstripping the government’s target of 6.7% and higher than 2011-2016. FDI hit a new record in 2017 at nearly US$35.9 million, representing a 44.4% increase compared to the previous year. Vietnam remains one of the most favourable destinations for foreign investment in South East Asia.

The Vietnamese real estate market continues showing irresistible appeal to foreign investors, mostly through merger and acquisition. Joint ventures have become popular among foreign developers who have strong financial capacity and track record, joining forces with local developers who own land and have strong connection with the local community. JLL observe there are hundreds of million dollars waiting to be poured into the market in most segments including residential, office, retail, hospitality and industrial. Investors are from many different countries such as Japan, Korea, Singapore, with an increasing number of groups from mainland China.

2017 proved to be an active year for merger and acquisition (M&A) activities in Vietnam real estate sector. Thu Thiem, the new urban development area of Ho Chi Minh City witnessed a number of high profile deals including the joint-venture partnership between Hongkong Land (HKL) and Ho Chi Minh Infrastructure Investment JSC (CII). On 12th December 2017, both parties signed a cooperation contract to jointly to develop Thu Thiem River Park project. JLL is proud to have been the consultant on this transaction.

Investors remain bullish on Vietnam real estate market with growing number of investors looking to acquire “clean and clear” land. In 4Q17, CapitaLand Limited acquired 1.45-hectare site District 4 for S$53.5 million (US$40 million), making it the 9th residential development in HCMC and 11th residential development in the country.

Another residential transaction involving VinaLand Limited, one of the real estate arms of Vina Capital, divested its entire stake in the Vina Square Project – a 3-ha development land in District 5, HCMC – to Tri Duc Real Estate Company for net cash proceeds of approximately US$41.2 million in which the repayment of shareholder loans is included. Once completed, this mix-used development project will supply over 1,000 residential apartments together with retail and office space.

The demand for operating office buildings in prime location continues to keep on rising. Within the first month of 2017, CapitaLand entered into a conditional agreement to acquire a prime commercial site in the CBD of HCMC to develop its first international Grade A office tower in Vietnam. CapitaLand acquired 100% stake in the 0.6-hecatre site with a gross floor area of 106,000 square metres (sqm). Mitsubishi purchased 11,000 sqm office component of Le Me’ridien from Tien Phuoc Real Estate JSC and 990 Co. Ltd.

A proportion of demand came from offshore capital sources, but the Continental Tower deal is latest show commitment from domestic buyers.

The strong demand to invest in Vietnam market is in line with continued demand for property in Asia Pacific in which the investment volumes across the region in the first nine months of 2017 reached US$97 billion, up 12% from the same period a year ago and is on track to reach our annual forecasts of US$130 billion. The blockbuster deal involving the transfer of Asia Square Tower 2 from BlackRock to CapitaLand Commercial Trust for S$2.1 billion (US$1.5 billion) – the biggest office deal in the APAC region in 2017 which spurs momentum for recovery in Singapore.

In 2017, Vietnam real estate market welcomes a record number of foreign capital investors, mainly private equity funds, looking to deploy their capital quickly and efficiently. Notable transaction involved the establishment of joint venture and strategic cooperation between Warburg Pincus and Becamex IDC Corporation to develop international standard logistics warehouses and to share capital market experience and assist Becamex to grow its business and customer base globally.

Investor Appetite in Vietnam

Traditionally, residential is still one of the most attractive sectors. Investors are now turning their target to commercial market especially Grade A office in a prime location with expected potential growth of capital value and yield compression (7%-8%). We notice that office rental rate in Vietnam are higher compare to other neighboring countries which reflecting an overall shortage of supply. In addition, investors continue to show good appetite for hotel assets.

Challenge in real estate investment in Vietnam

For residential and commercial projects, foreign investors often search for "clean" land (i.e. compensation completion, site clearance, land use fees have been paid, land use right is in place, and good planning). However, those assets are rare as the Vietnamese realty market is still immature.

In addition, The Vietnamese real estate market is tightly held and open market offerings in this high-growth, high-potential sector are rare. The accessibility to the good assets is quite limited; most foreign investors are working with investment consultancy to enter this market.

Market Outlook- Bigger Appetites

There is currently strong interest in Vietnam real estate from foreigner investors, and we expect this theme to continue for the foreseeable future. There will continue to be a strong preference for income producing assets, however given the shortage of this type, there will be a continued focus on development activity. We are seeing more partnerships and Joint Ventures forming between local companies and foreign investors, we expect this trend to continue.

When looking at the market as a whole we expect continued growth through most asset types. Hospitality has been interesting over the past year with new funds with foreign capital now specifically targeting this sector. We expect that this trend will continue in hospitality, and in other growing sectors such as Industrial and alternatives like education. The affordable housing market is another key growing sector, now drawing specialist capital sources who identify value in these underlying fundamentals including growing middle class.

There are more foreign investors entering Vietnam, and opening new offices here. Typically, these investors were on a fly-in fly-out basis on their first investment, while now for subsequent investments they have set up local teams comprising a combination of local and expat operators. Due to the strong focus on Vietnam from regional investors, we expect M&A activities to reach record levels in 2018.

For more information about Vietnam M&A activities phone or email Phuong Le, Investment Analyst, Capital Markets, Vietnam, JLL.

Source: JLL

Similar to this:

As demand for office space outpaces supply, what lies ahead for the Ho Chi Minh City Office Market?

Thu Thiem set to relieve Ho Chi Minh City’s infrastructural challenges

CapitaLand to develop 870-unit residences in Ho Chi Minh City at US$38.9m site