Smaller, cheaper units reported strongest sales in Jakarta's high rise residential market

Contact

Smaller, cheaper units reported strongest sales in Jakarta's high rise residential market

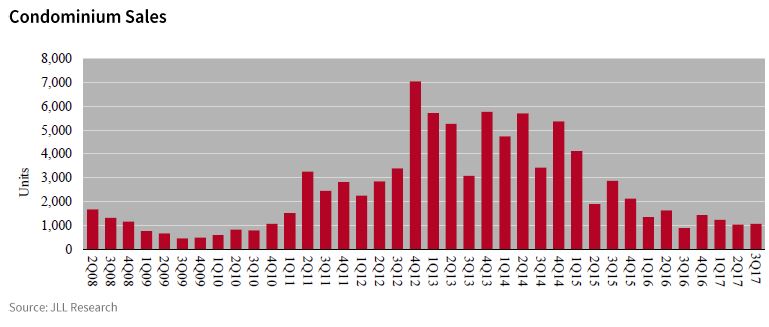

JLL’s Jakarta Property Market Review Q3 2017 shows the luxury end of the market has been weaker since 2015.

Demand for property in Jakarta has been strongest in the middle and lower segments which offer greater affordability and a lower tax burden, according to JLL’s Jakarta Property Market Review Q3 2017.

While the market has not seen wholesale improvements from the downturn in 2015, some condominium projects have sold well in recent quarters. Smaller units, cheaper prices, good access to existing and upcoming infrastructure, desirable amenities and good developer reputations are all selling points. One of the quarter's new launches, Fifty Seven Promenade and The Newton at the Ciputra World 2 development are examples of recent projects that have performed well.

Luxury sales have been weak since mid-2015 and this may remain to be the case as long as luxury (20% on units over IDR 10 billion) and super luxury (5% on units over IDR 5 billion) taxes remain in their current format.

The market is likely to remain locally dominated as foreign ownership regulations are such that they are unlikely to generate a significant source from either non-Indonesian resident in Jakarta or overseas investors.

Fifty-Seven Promenade was launched to the sales market. This project is developed by Intiland (with GIC as a newly announced partner) and is extremely centrally located within walking distance of the Hotel Indonesia roundabout in the traditional centre of the city. While the per sqm prices are at the higher end of the market, the unit sizes on offer are an acknowledgment of the kind of units which are selling well in the current market.

The new launch profile is likely to mirror demand in that in a period of weaker luxury demand, developers may target other, more active market segments. Smaller unit sizes and cheaper prices are likely to continue to be the strongest sellers and as such - developers are expected to offer more of these types of units.

Condominium prices continued to edge up marginally in lower end developments where demand was strongest. Developers of higher-end projects, however, kept primary market prices flat; a continuation of the prevailing trend since 2015

Click here to download the JLL Jakarta Property Market Review Q3 2017

Similar to this:

Smart city initiatives critical for Indonesia's urban growth

Savills reports on Jakarta’s new developments, apartments and foreign investment

Jakarta’s luxury housing market sluggish while demand increases for smaller units