Yangon’s demand for lower-tier, better quality developments

Contact

Yangon’s demand for lower-tier, better quality developments

With only 17% of the supply of apartments affordable and good quality, Colliers urges Myanmar developers to veer away from upscale offerings.

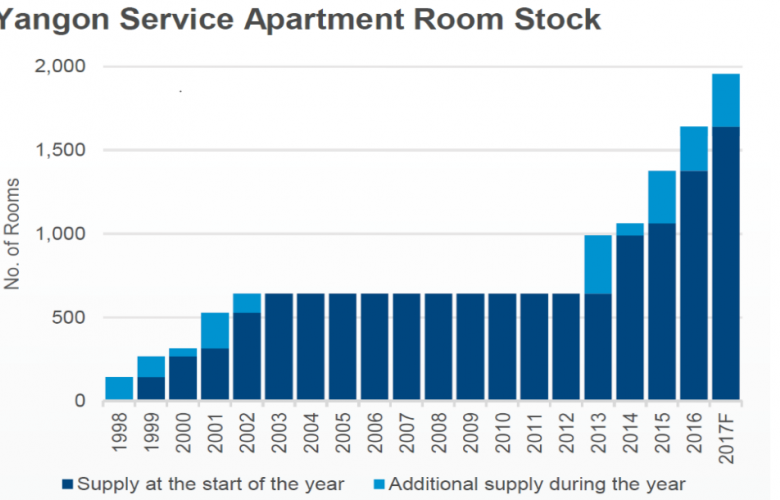

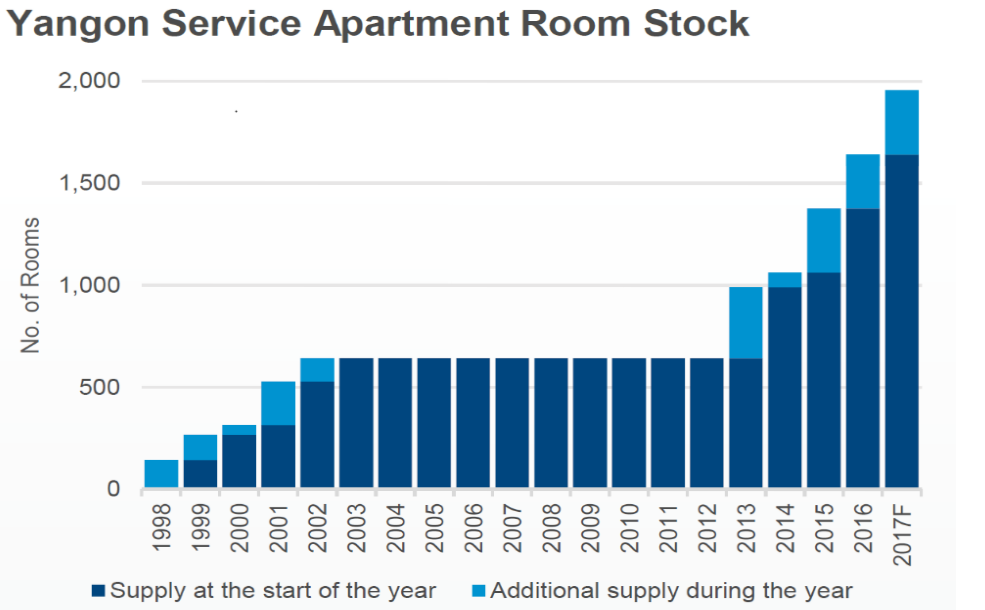

Yangon’s serviced apartment stock is unchanged at 1,640 units over the last two quarters, but expected to grow by 15% YoY with the completion of Hotel Lotte and Serviced Apartments in Q3 2017. The Korean and Myanmar joint venture is expected to be the largest hotel complex in Yangon, with 315 serviced apartments.

Source: Colliers International Myanmar

The medium term pipeline is weak, and construction delays could lead to fewer new projects for the rest of 2018. Future developments are slowly building up, but there is limited progress with some being temporarily shelved. The completion schedule appears on track for a few, likely to be delivered from 2019 throughout 2020. These include Kantharyar Serviced Residences in Mingalar Taung Nyut Township, Junction City Sedona Suites in Pabedan Tonwhip, as well as The Loi and Somerset @ 68 Residence in Bahan Township. Long term developments such as Golden City, HAGL Myanmar Centre, Polo Club Asia Residence, and Inno City, are also planned. But many future developments are skewed upscale, unsuited to the current demand.

Click here to dowload the full Colliers Yangon Apartment Report

Housing budgets remain key amongst most businesses and Yangon’s reputation for high rents associated with upscale developments mean most expatriates settle for housing options typically of poor quality. This is a stark contrast to Bangkok where product offerings are varied, and good quality condominiums, serviced residences, and apartments come at a reasonable price.

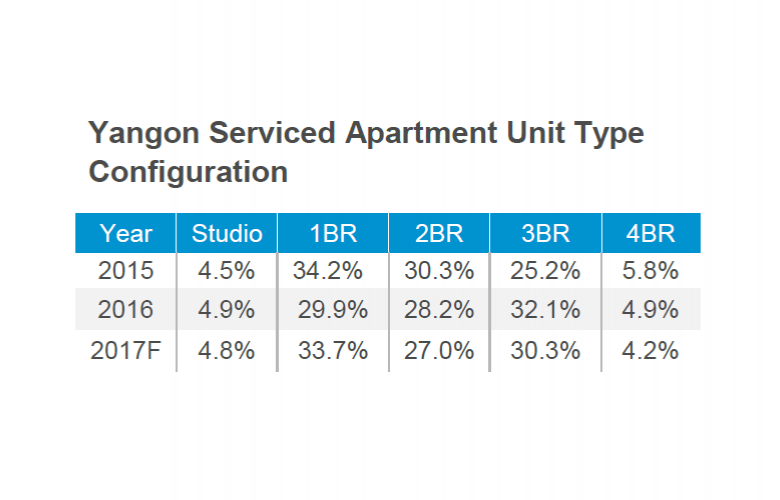

Affordable, good quality serviced apartments in Yangon appears limited being only 17% of the total supply, with little evidence of increase in the medium term. The majority of the future developments consists of two and three bedroom units. Colliers urges developers to take particular interest in building more limited or mid-tier serviced apartments that offer smaller sized units such as studio and one-bedroom units at competitive rates. Many recently built lower-tier projects have begun adopting these configurations and are currently benefitting from robust demand. As of Q2 2017, these developments collectively achieved an unprecedented 90% occupancy and are geared to continually rise given the dearth in immediate new supply. Many tenants are veering away from poorly maintained serviced apartments, moving into newer projects, although smaller, are equipped with basic facilities and offer modern comforts.

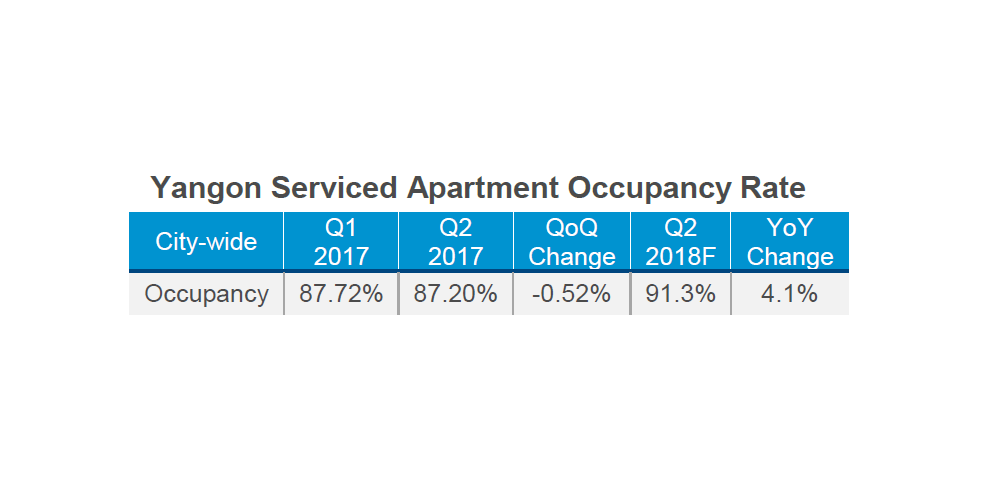

Source: Colliers International Myanmar

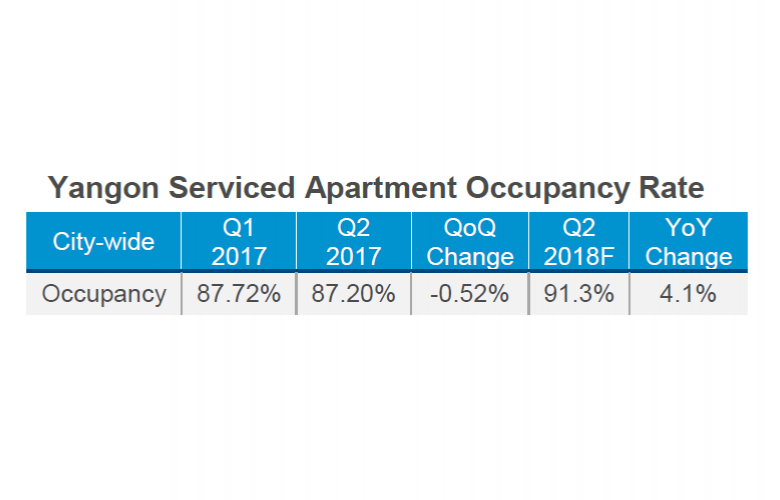

The average occupancy rate has remained stable QoQ at the sub-87% level, with a temporary decline over the next quarter upon completion of Hotel Lotte & Serviced Apartments. Colliers’ medium term forecast remains positive particularly in 2018 given the probable absence of new projects, and the continuous rise in expatriate demand. The trend should be more pronounced across lower-tier, modern serviced apartments.

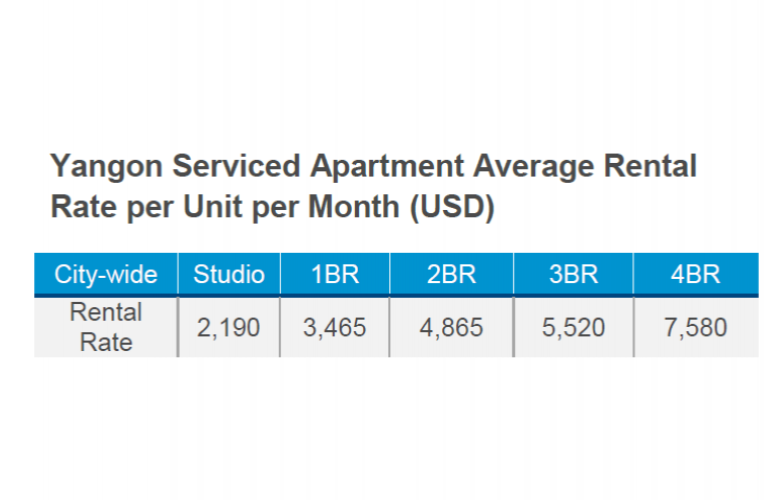

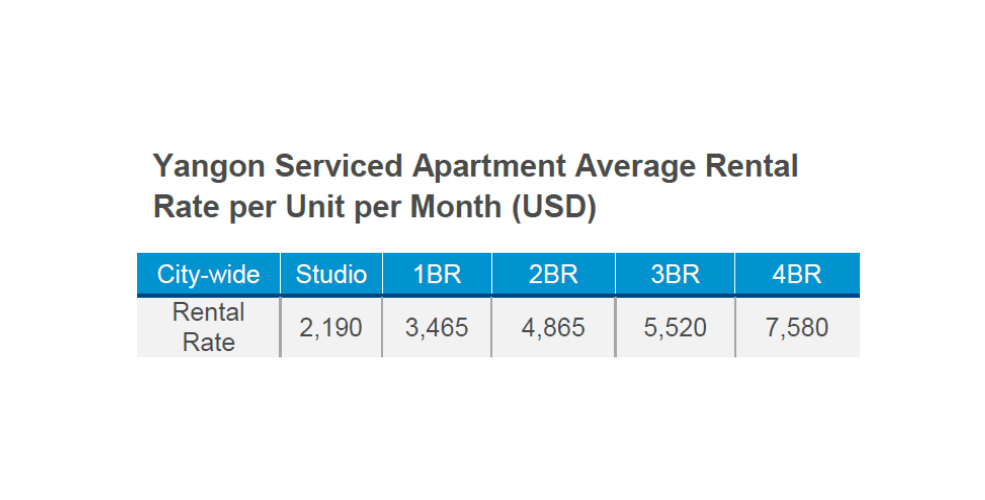

Rental rates are becoming more competitive after correcting downwards over the previous years, following the trend of more affordable developments. Upscale developments have witnessed limited price movements, with the anticipated rise in competition to exert downward pressure on rental levels in the long term. Colliers expects rates to remain generally the same for the rest of the year, and increase modestly in the next 12 to 18 months.

Source: Colliers International Myanmar

For more information, email Karlo Pobre from Colliers International via the link below.

This article was first published on The Mingalar Real Estate Conversation

Similary to this:

Long Stay serviced apartment in the heart of Yangon, Myanmar

Stronger Investment Interest Surfaces in Ngapali (Thandwe), Myanmar